The Top 14 Metrics SaaS Companies Should be Tracking Now

A successful and sustainable business is one in which every member of the team brings value. That’s why every employee, either directly or indirectly, is responsible for optimizing the flow of revenue across the broader pipeline.

Revenue analysis and optimization goes beyond sales and finance alone to provide full-funnel accountability and achieve closer alignment between sales, marketing, and service teams. Properly implemented, it enables data-driven decision-making, both strategic and tactical, across your entire team. And in doing so, establishes a company culture focused on close collaboration aimed at efficiency driving revenue growth.

Introduction

SaaS businesses face unique challenges and opportunities when it comes to data. Invariably, they’re data-rich environments, but that data is of little relevance if you don’t know which metrics to track and which questions they answer, nor have the means to distill all that data into actionable insights.

In this post, we’ll explore some of the most important metrics for informing your organization’s course of action and finding answers to questions like:

- Is my current go-to-market plan financially viable?

- What’s working well, and where is there room for improvement?

- What are the main business priorities I should be focusing on?

Addressing such questions necessitates shifting the focus from growth to efficiency across the board. This requires every department to obtain a granular view of how their operations impact revenue as part of the entire value chain.

SaaS Finance Metrics

Financial metrics give you a high-level view of the financial health and viability of your business model. By drilling down into these metrics, you can gain valuable insight into the effectiveness of specific go-to-market strategies, departments and processes.

1. Customer acquisition cost (CAC)

To acquire new customers, SaaS businesses must devote a substantial amount of time and resources before they start seeing a return on their investments. While it’s normal for emerging SaaS businesses to take longer than others to become profitable, CAC should always fall over time when compared to your LTV. If the LTV/CAC ratio is under 1.0, the company is losing value, while a growing business should typically have a ratio of over 3.0.

2. Customer lifetime value (LTV)

Any service-based business model revolves around how much revenue a customer typically brings during their relationship with your company. A financially healthy, established business will always have a substantially higher LTV than CAC. A higher LTV is a good indicator of a strong product market fit and brand loyalty.

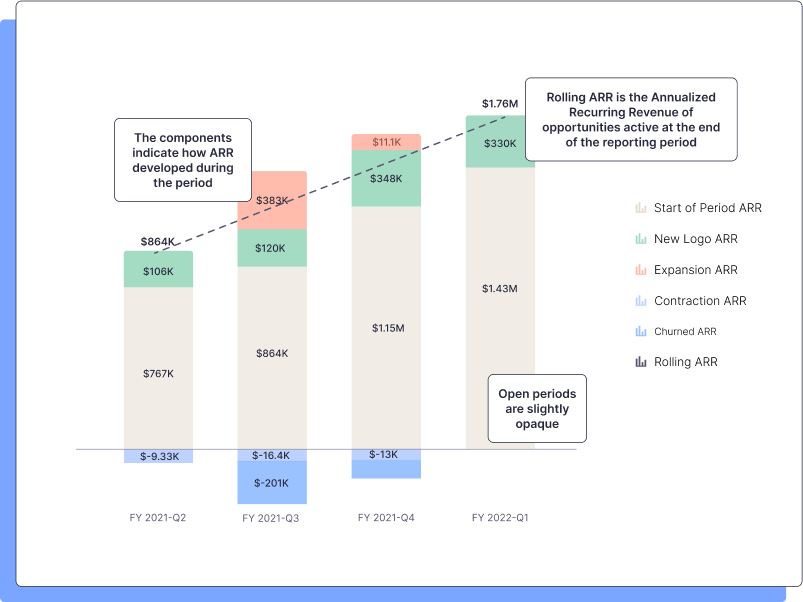

3. Annual Recurring Revenue (ARR)

ARR gives leaders a top-level view of their revenue-generating activities. It may be further distilled into specific areas, such as variable and one-time transactions, cross-sells and upsells, revenue generated by new business, and subscription contract upgrades.

Knowing your ARR helps you make informed budgets for key operations like marketing and support. Note that businesses may have one or more ways of measuring ARR (such as Committed ARR and Active ARR), depending on their specific business goals.

Read more about Annual recurring revenue (ARR).

SaaS Revenue Operations Metrics

Since SaaS companies primarily carry out their marketing exclusively, or almost exclusively, in the digital space, they typically have an immense amount of sales and marketing data at their disposal. This is why it’s important not to focus on vanity metrics, such as website visitor count or the number of social media followers, but rather on those that contribute to revenue.

4. Conversion rate

In SaaS, a conversion is usually considered a customer who has signed up for a paid subscription to your product or service . However, there are several types of conversion metrics that you need to track, depending on your sales and marketing strategy (for example, the pipeline conversion rate). For example, if you offer free trials or a freemium service, you’ll want to establish different benchmarks for each channel.

5. Pipeline health

A sales pipeline is the aggregation of sales funnels into a collective view of the effectiveness of your sales operations. There are several important metrics for measuring the health of your sales pipeline, such as the number of deals in the pipeline, the average size of those deals, the velocity of sales and the opportunity win rate (the percentage of deals which have been closed).

6. Quarterly forecast

Forecasting sales is essential for defining sustainable budgets for sales and marketing teams. Accurate forecasting requires an understanding of bias to represent historic average error rates and precision, which represents the spread between the forecast and the actual value.

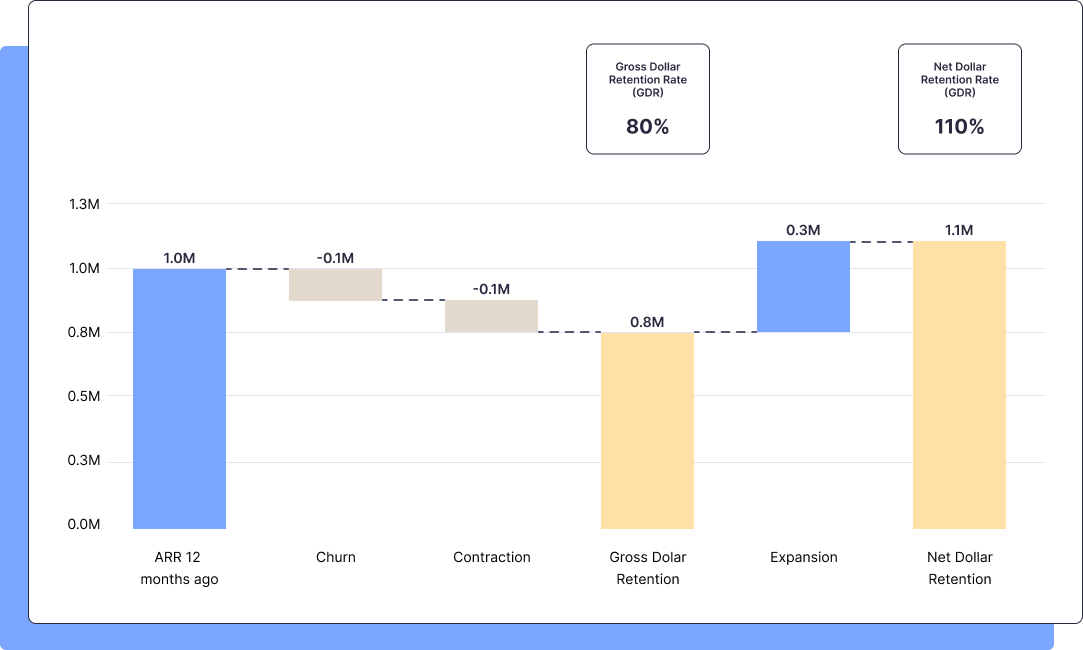

7. Net Revenue/Dollar Retention Rate (NRR/NDR)

This is one of the most valuable business metrics for SaaS companies. It represents the growth percentage of recurring revenue retained and expanded from existing customers over a given time frame, such as a month or a year.

NDR above 100% indicates revenue growth among existing customers due to things like account upgrades, while NDR below 100% indicates the opposite. A good NDR number can range between 90% to 120%, depending on the business strategy and customer profile.

Read more about Net Revenue/Dollar Retention Rate (NRR / NDR).

8. Funnel leads and velocity rate

These metrics are essential for sales and marketing teams to evaluate the effectiveness of their campaigns. The sales funnel outlines prospect’s journey towards becoming a customer, and it’s important to know when people are dropping out of the funnel before you can understand why. For example, if prospects are dropping out of the sales funnel during a free trial period, this could point to your product being too expensive or not offering enough value for it to be worth upgrading.

You can measure the effectiveness of each stage of your sales funnel by measuring the percentage increase of leads over a given period. In a healthy business, the lead velocity rate (LVR) should be growing steadily. Read more about funnel leads and velocity rate.

SaaS Customer Success Metrics

SaaS product metrics are vital for companies looking to gain insights into how customers engage with their products and services. As with sales and marketing, they should avoid focusing on vanity metrics such as the number of user accounts.

9. Active user count

Active users are those who regularly engage with their subscriptions. Depending on the nature of the service, active users might be measured on a daily, weekly, or monthly basis. Insofar as revenue operations are concerned, active user count should cover paying customers. It’s also important to measure activation rate, which refers to the percentage of customers that go from being newly acquired to actually using your software.

10. Behavioral metrics

Understanding how users engage with your product is essential for determining which features are popular, which ones need improvement, and which ones can be deprecated, especially since this has a direct impact on the percentage of retained customers. For example, you can measure customer usage and engagement with new features, either as a share of monthly users or by absolute count.

You can also garner valuable insights into user behavior by tracking customer service metrics, such as the number of support tickets opened, since these help you identify where customers might routinely be having problems engaging with your product, as well as how much time they spend using a specific function.

11. Net promoter score (NPS)

NPS is a proprietary metric developed and maintained by Satmetrix. It has become an industry standard for measuring customer experiences and predicting business growth, particularly for SaaS companies. NPS is usually calculated via customer surveys, with the goal to provide a score on a scale of one to 10 to measure overall customer satisfaction.

SaaS Human Resources Metrics

Last, but certainly not least, we have HR metrics, which also have an indirect, albeit significant impact on your revenue. After all, the business’s employees are the ones who ultimately determine customer success and, therefore, growth.

12. Employee turnover rate (ETR)

As in most industries, SaaS faces a high attrition rate, especially in the era of hybrid work and the numerous opportunities for workers that come with it. As a result, some SaaS companies have had to replace a large percentage of their employees in the last few years, to the point where it has had a huge impact on profitability.

13. Time to productivity

It typically takes around six months for a new hire to reach peak productivity, depending on the degree of skill and specialization required for the role. From the perspective of revenue analysis and optimization, a longer time to productivity means a longer time before a new hire has a significant impact on company revenue.

14. Employee experience metrics

Employees are effectively internal customers, which is why forward-thinking SaaS businesses tend to approach their employees’ experiences similarly to how they approach their customers’ experiences. These metrics also cover a broad range of activities and may be collected via employee app usage statistics or employee satisfaction surveys.

How to Move Forward on Tracking SaaS Metrics?

Now that you know what are the best SaaS tracking metrics, you need to figure out when to use them, what business questions they answer, and how to calculate them. As a first step, you can click on the links above as each of them leads to a glossary page that answers these questions.

Another option is to start working with Sightfull’s revenue analysis and optimization platform which transforms raw, real-time SaaS data into actionable insights that drive strategic go-to-market decision-making.

Sightfull provides hundreds of pre-calculated metrics and dozens of detailed dashboards out-of-the-box. No more creating spreadsheets to calculate these metrics, or relying on the packed schedules of your data analyst team to do the time-consuming work.

Book a demo today to see Sightfull in action.

Frequently asked questions

What are the four main categories of SaaS metrics?

- Financial metrics

- Revenue operations metrics

- Customer success/product metrics

- Human resources metrics

What are the different types of ARR?

Annual Recurring Revenue (ARR) represents the annualized value of the recurring revenue from active accounts in each period. The amount of ARR is based on the closed-won opportunities related to each customer account. This metric can be broken down into the different types of ARR in each period, including New Logo ARR, Expansion ARR, Contraction ARR, Churn ARR and ARR at the Start of Period.

Why is it important to measure Net Dollar Retention Rate (NDR)?

NDR is a key performance indicator for measuring the health, growth and long term resilience of a business. It is especially important for SaaS B2B companies, who often invest heavily early on in customer acquisition, and expect to recoup the initial spend by retaining and expanding accounts at a relatively lower cost.

Why is Pipeline Conversion Rate important to measure?

The Pipeline Conversion Rate metric is one of the most used and impactful metrics. It provides a measure of success in converting the potential revenue of open opportunities in the pipeline to the actual revenue of Bookings. It is useful in comparing the performance of different teams and sales people, as well as how well opportunities from different lead sources and industries are converting.

Talk to an expert

See which metrics your SaaS company should track

Precisely track and analyze your revenue performance

Gain access to essential insights and trends that directly impact your ability to drive revenue growth and enhance business performance.