What is Net Retention Rate and How to Calculate it?

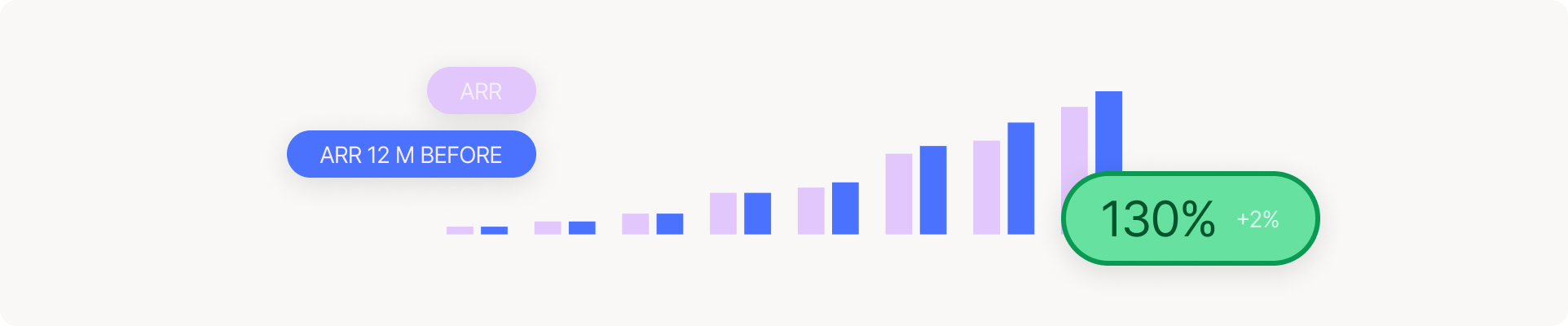

Net Retention Rate (NRR), also known as Net Dollar Retention (NDR), is a critical performance metric for subscription-based businesses, especially in SaaS. This metric measures how much recurring revenue is retained from existing customers, accounting for expansions, downgrades, and churn. Understanding your net retention rate allows you to track growth from existing customers without factoring in new customer acquisition. How to calculate net retention rate: divide the monthly recurring revenue (MRR) from existing customers at the end of a period by the MRR at the beginning of the same period, adding any upsells or expansions and subtracting downgrades and churn. This gives a percentage that shows how much revenue is retained and grown through the current customer base.

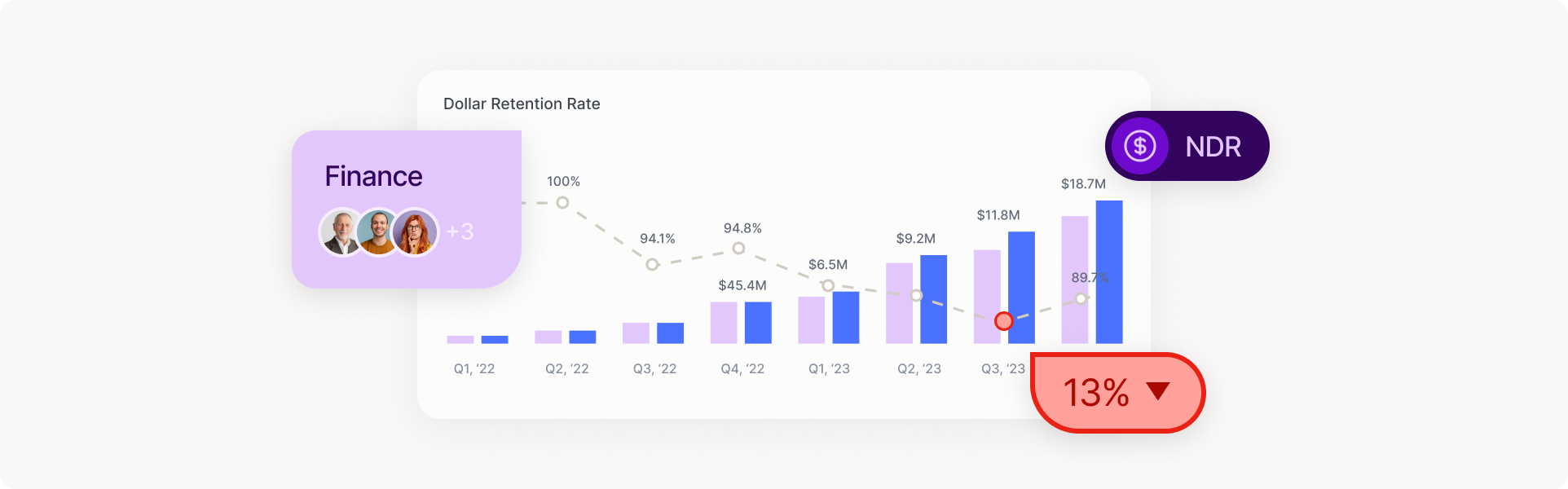

What is Net Dollar Retention (NDR) in Business?

Net Dollar Retention (NDR), often referred to as Net Revenue Retention (NRR), calculates the percentage of revenue retained from the existing customer base after factoring in upsells (expansions), churn, and contractions. A high NDR metric shows that your company is growing its revenue from its existing customers, while a low NDR could indicate that churn and downgrades are eating into your recurring revenue.

Key Definitions:

- NDR SaaS: The NDR metric is crucial for SaaS companies to measure long-term revenue sustainability.

- NDR Finance/Banking: NDR banking can also refer to the retention of clients or their investment portfolios over time.

NRR vs. Gross Retention Rate (GRR)

While Net Retention Rate (NRR) tracks overall revenue growth from current customers, Gross Retention Rate (GRR) measures only the retention of revenue without accounting for expansion. GRR is typically lower since it excludes upsell opportunities.

Key Differences: NRR vs. GRR

Net Retention Rate (NRR) measures the overall growth of revenue from your existing customer base. It accounts for not just churn (customers who cancel their subscriptions) and contraction (customers who downgrade), but also for expansions—additional revenue generated from upsells or cross-sells. This means NRR provides a full picture of how your customer base is contributing to revenue growth.

- Use Case: NRR is used to track how effectively a business grows its revenue from existing customers. It's particularly useful for understanding the impact of customer expansion on your revenue, making it a key metric for companies focused on long-term growth.

- Key Insight: A high NRR (over 100%) means the business is growing its recurring revenue from existing customers, even before acquiring new customers.

Gross Retention Rate (GRR), by contrast, measures only how much revenue is retained from existing customers, excluding any revenue gained through expansions. GRR focuses on how well a company is maintaining its customer base without upselling or cross-selling.

- Use Case: GRR is primarily used to understand pure customer retention, offering insights into how well a business is preventing customer churn. It's a baseline health metric that shows how much revenue is at risk of being lost.

- Key Insight: A high GRR (close to 100%) indicates strong customer loyalty and satisfaction, with minimal churn.

Why Net Retention Rate Matters

For SaaS and other subscription-based models, Net Retention Rate (or Net Dollar Retention) is critical for measuring customer loyalty, growth, and long-term business health. Here’s why it’s so important:

- Customer Retention: A high NDR metric means that your company is not only retaining customers but also growing revenue through expansions. A low NDR could signify churn or customer dissatisfaction.

- Revenue Growth: NRR sales strategies can highlight opportunities for increasing revenue through upsells and cross-sells. This leads to organic growth without depending on new customers.

- Strategic Decision-Making: Businesses can allocate resources more effectively by understanding their net retention rate. A higher NRR means you can afford to invest more in existing customers, whereas a lower rate may indicate a need for better customer retention strategies.

How to Calculate Net Revenue Retention (NRR)

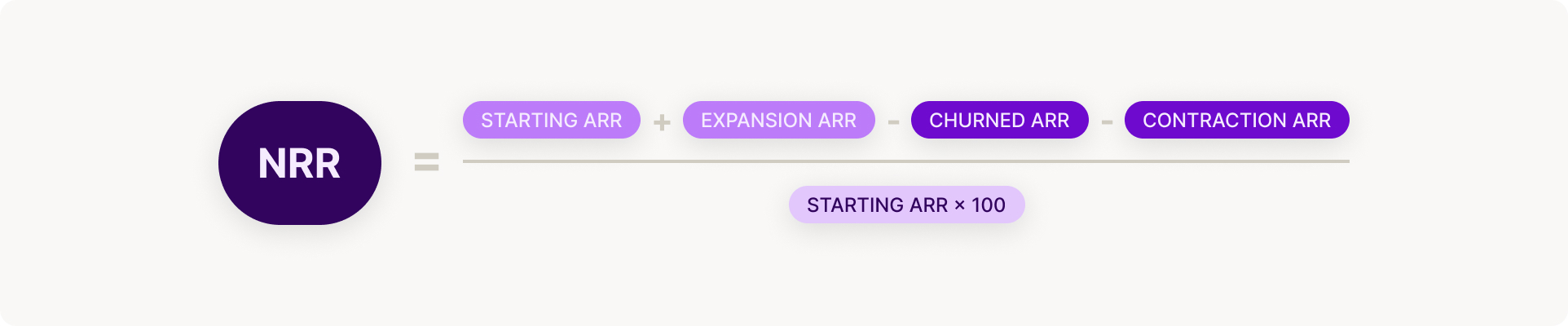

The Net Dollar Retention Calculation is straightforward when broken down:

- Starting ARR: Annualized Recurring Revenue at the beginning of the period.

- Churned ARR: The lost revenue from customers who canceled their subscriptions.

- Contraction ARR: Revenue lost due to customers downgrading their services.

- Expansion ARR: Revenue gained from upsells or cross-sells within existing accounts.

NRR Formula:

NRR = (Starting ARR + Expansion ARR - Churned ARR - Contraction ARR) / Starting ARR × 100

Example:

Let’s assume a company starts with $100,000 in ARR:

- Churned ARR: $10,000 (lost due to canceled accounts)

- Contraction ARR: $5,000 (revenue lost due to downgrades)

- Expansion ARR: $20,000 (gained from upsells)

NRR = (100,000 − 10,000 − 5,000 + 20,000 / 100,000 ) = 105%

This net dollar retention calculation shows a 105% NRR, indicating net revenue growth.

Common Mistakes to Avoid:

- Neglecting downgrades: Always account for revenue reductions due to customers downgrading their services.

- Inconsistent timeframes: Ensure that you're using the same period (monthly, quarterly, annually) across all components of the NRR formula.

NRR Benchmarks

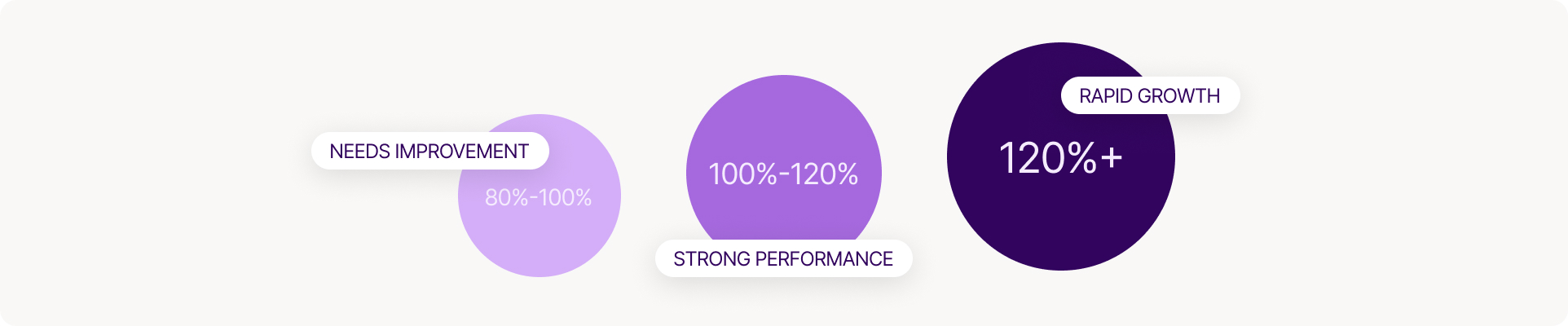

Understanding how your Net Retention Rate (NRR) compares to industry benchmarks is essential for assessing your business’s customer retention and revenue growth strategy. Here’s a concise breakdown of key benchmarks for SaaS and subscription-based businesses:

120%+ NRR: Rapid Growth

- What it Means: A Net Dollar Retention (NDR) over 120% indicates that your business is growing quickly through effective upselling and cross-selling strategies. The revenue gained from existing customers exceeds any losses from churn or downgrades.

- How to Compare: If your NRR is over 120%, your business is in a very strong position, retaining and expanding customers. Focus on maintaining these strategies to ensure continued growth.

100%-120% NRR: Strong Performance.

- What it Means: An NRR in this range reflects good customer retention with moderate net growth from expansions. You’re successfully retaining customers, but there’s still room to increase upselling.

- How to Compare: If your NRR is between 100%-120%, you're doing well, but there’s potential to push for greater growth by further reducing churn and driving more expansion MRR.

80%-100% NRR: Stable but Needs Improvement

- What it Means: An NRR between 80%-100% shows stable customer retention, but no significant net growth. This range suggests struggles with churn, downgrades, or missed opportunities for upselling.

- How to Compare: If your NRR is below 100%, focus on reducing churn and improving customer success efforts to drive upsell opportunities and increase Expansion MRR.

Strategies to Improve Net Retention Rate

- Upsell and Cross-Sell: Driving expansion ARR is one of the most effective ways to increase your net dollar retention rate. Offering complementary products or higher-tier services can lead to more revenue from your existing customer base.

Actionable Tip: Use data analytics to identify high-potential customers for upselling. - Proactive Customer Engagement: Engaging customers with regular check-ins, personalized offers, and early intervention can reduce churn and downgrade ARR.

Actionable Tip: Implement automated customer success outreach based on user activity and product engagement. - Customer Success and Onboarding: A seamless onboarding experience and ongoing customer success efforts improve overall satisfaction and NRR.

- Actionable Tip: Develop onboarding programs that ensure customers receive immediate value from your product, reducing early churn.

Common Pitfalls in Managing NRR

Managing Net Retention Rate (NRR) effectively is critical to sustaining growth, especially for SaaS businesses. However, many companies fall into common traps that can distort their NRR and hinder long-term performance. A clear, consistent definition of how NRR is calculated is essential to ensure accurate tracking and avoid these pitfalls.

Over-reliance on Upsells

One of the most frequent mistakes is focusing too heavily on expansion ARR (from upsells and cross-sells) while neglecting churn and downgrades. Although this may temporarily boost NRR, the underlying churn can damage long-term growth. Over-reliance on upsells can mask serious issues with customer retention and satisfaction, leading to instability once upsell opportunities diminish.

Why It Matters: Having a clear governance framework ensures that expansion revenue isn’t used to cover up increasing churn rates. If churn and downgrades are not monitored carefully, the business may fail to address critical customer issues early enough.

Ignoring Early Warning Signs

Metrics such as declining engagement, usage rates, or frequent downgrades often precede churn. Businesses that don’t pay attention to these early signals may experience a sudden drop in NRR. For example, if customers downgrade their subscription plans or reduce usage, it’s often a sign of dissatisfaction or a lack of perceived value, which can lead to cancellations if not addressed proactively.

Why It Matters: To ensure a balanced approach to NRR growth, businesses must track not only expansion but also leading indicators of churn. By setting up a standardized system for monitoring NRR components, including customer engagement metrics, companies can catch issues before they escalate into churn.

Maintaining Clear NRR Definitions and Governance

A central challenge in managing NRR effectively is ensuring that everyone in the organization is using the same definition and calculation methods. Inconsistent approaches to NRR calculation can distort performance insights, making it difficult to track true customer retention and expansion trends. This can lead to over-optimism in growth projections or missed signals on churn risk.

Why a Centralized Definition is Key:

- Consistency: Without a clear, centralized definition of how NRR is calculated, different teams may track the metric differently. Some may omit important details like downgrades or use different timeframes, resulting in inaccurate or misleading insights. A standardized approach ensures that all stakeholders are aligned.

- Accountability: Good metric governance establishes accountability across departments, ensuring that each team is responsible for both customer retention and expansion efforts. For example, the customer success team must focus on minimizing churn, while sales focus on upselling. Consistent NRR governance ensures that both sides of the equation are balanced.

- Reliable Benchmarking: A clearly defined NRR formula enables businesses to compare their performance accurately against industry benchmarks. This also ensures that investors and stakeholders have a clear, transparent view of the company’s growth potential, avoiding misrepresentation of financial health.

Conclusion

Monitoring and optimizing your Net Retention Rate (NRR) is essential for long-term business success, especially in subscription-based industries like SaaS. By understanding how to calculate net retention rate, implementing proactive strategies to reduce churn, and leveraging upsell opportunities, businesses can increase their NRR and drive sustainable growth. Regularly reviewing your NRR alongside key metrics will ensure you stay on track for continued success.

Sightfull pre-built NDR Reporting Template

All the SaaS revenue metrics you need

Net dollar retention rate is only one of the hundreds of SaaS metrics that are available out-of-the-box to users of the Sightfull revenue analysis and optimization platform. They include all the critical metrics required for SaaS companies - from indicators regarding campaigns and leads, through those that track pipeline, conversion and bookings, and all the way to later signals such as retention and expansion.

These highly precise customizable metrics are automatically calculated based on a large repository of SaaS industry standards, best practices and benchmarks. This saves lots of time for RevOps teams since they don’t have to rely on data analysts for support, waste time on error-prone spreadsheets, or manually create and update dozens of reports.

Sightfull users also receive dozens of pre-built dashboards based on these metrics, enabling them to easily investigate revenue trends at a highly granular level, identify their root causes, and act on proactive insights regarding time-sensitive business issues.

Related Metrics

Also known as:

- Net revenue retention

- Net retained revenue

- Customer revenue retention

- Customer dollar retention

Sightfull is your automated GTM analytics platform.

Low touch, quick deployment paired with automation ensures fast results across any interface of your choice.