Part 1: The Ultimate Guide to B2B SaaS KPIs: Mastering Revenue & Growth Metrics

Co-founder & CTO

Data. It's not just numbers; it's the story of your SaaS business.

And if you're not obsessed with your KPIs, you're missing out—big time. Seriously, the companies crushing it? They're the ones treating data like gold, like it's the key to unlocking insane growth (which it is). But let's be real, picking the right KPIs and tracking them? That's where it gets tricky.

It's a firehose of metrics, dashboards, and spreadsheets. This guide? Think of it as your data sherpa, your cheat sheet to SaaS KPI mastery. We're breaking it down into three digestible parts, starting with the fundamentals: Revenue & Growth KPIs.

This is your foundation, the bedrock of your business. Get ready to unlock your data's true potential, get crystal-clear insights into your financial performance, and watch your growth skyrocket. We'll cover everything from ARR (your North Star) to Churn (your leaky bucket), giving you a solid grasp on what actually matters.

What is a Key Performance Indicator (KPI)?

In business, data is everywhere. But raw data alone rarely tells the full story. It's like having all the ingredients for a gourmet meal but not knowing how to cook.

The real power comes from the insights you pull from this data. That's how you make informed decisions and drive real growth. That’s where KPIs come into play. A KPI is a measurable value that shows how effectively a company is achieving key business objectives. It's a quantifiable metric that paints a clear picture of your progress towards a specific goal.

Think of KPIs as the vital signs of your business. They're the pulse, the heartbeat, the telltale signs of whether your business is thriving or just barely surviving. They give you the critical information you need to understand its overall health and performance.

Unlike basic metrics, which simply measure something, KPIs are directly tied to your strategic goals. Metrics are the raw ingredients – think website visits or emails sent. KPIs are the finished dish, telling you how those ingredients contribute to a specific outcome, like boosting website conversions or generating new leads.

For example, "website traffic" is a metric, but "conversion rate of website visitors into trial signups" is a KPI. See the difference?

This distinction is crucial: KPIs provide context and direction. They translate raw data into actionable insights. They don't just tell you what is happening, but how well you're doing relative to your objectives and what you need to focus on to improve. They're your compass, guiding you towards the true north.

The Power of KPIs

KPIs are essential for several reasons

- Strategic Alignment: This is how you get everyone on the same page. KPIs ensure everyone in your organization is rowing in the same direction, working towards the same goals. They provide a shared understanding of what success looks like and how progress will be measured. No more silos, just a unified front.

- Data-Driven Decisions: Forget gut feelings, let the data do the talking. KPIs give you the hard data you need to evaluate the effectiveness of your strategies. They eliminate guesswork and enable informed decisions based on measurable results. No more gut feelings, just cold, hard facts.

- Performance Monitoring: Keep your finger on the pulse. KPIs let you track performance over time, spot trends, and pinpoint areas for improvement. They're your continuous feedback loop, enabling proactive adjustments and optimization. Think constant iteration, always improving.

- Accountability: Make everyone own their results. KPIs create a sense of accountability within teams and across the entire organization. They clearly define expectations and provide a framework for measuring individual and collective performance. Everyone knows what they’re responsible for.

- Communication: Show your stakeholders the impact you're making. KPIs make it easy to communicate progress and success to stakeholders, including executives, investors, and board members. They're a concise and objective way to demonstrate the impact of your initiatives. Show, don't just tell.

Choosing the Right KPIs (The SMART Framework)

With so many potential metrics to track, picking the right ones can feel like a total headache. And let's be honest, not all metrics are created equal. Picking the wrong ones? Total waste of time and resources, a major distraction from what actually matters. You want KPIs that are truly effective, KPIs that stick to the SMART framework:

- Specific: Get laser-focused. Clearly defined and aimed at a specific objective. Ditch vague KPIs like "improve customer satisfaction." Go for something concrete like "increase Net Promoter Score by 10 points."

- Measurable: If you can't measure it, you can't improve it. You need numbers, hard data. Pick KPIs you can objectively measure, not fuzzy feelings or opinions. Instead of "enhance brand awareness," shoot for "increase website traffic by 20%."

- Attainable: Keep it real. Realistic and achievable within a specific timeframe. Set challenging but realistic targets to motivate your team and avoid burnout. Don’t set yourself up for failure.

- Relevant: Make sure it matters. Your KPIs should align with your overall business goals and strategy. They should contribute to the big picture, not just be random metrics floating around. Everything needs to work together towards your main goal.

- Time-bound: Deadlines drive action. Give yourself a timeframe for measurement and evaluation. Set deadlines and milestones to track progress and stay accountable. Because let's face it, deadlines get things done.

Stick to the SMART framework, and you'll nail it every time. Your KPIs will be laser-focused, measurable, achievable, relevant, and time-bound. This makes them super effective, giving you the insights you need to seriously grow your business. Remember, it's not just about collecting data – it's about making that data work for you. It's about turning data into dollars.

Revenue & Growth KPIs: The Heart of Your SaaS Business

These KPIs are the lifeblood of your SaaS business. They give you critical insights into your financial health and growth trajectory. They tell you how much money you're making, how quickly you're growing, and how well you're keeping your customers happy. This is the stuff that matters.

Annual Recurring Revenue (ARR): Your North Star Metric

ARR is the holy grail of SaaS metrics. It's the predictable, recurring revenue normalized to a year. It’s the heartbeat of your business, giving you a clear picture of your financial stability and growth potential. This is the metric that VCs drool over.

Why ARR Matters:

- Financial Planning: ARR is the foundation of your financial planning. It helps you project future revenue, budget effectively, and make informed investment decisions. It's your financial crystal ball.

- Investor Relations: Investors use ARR to assess the health and growth potential of your business. A consistently growing ARR makes your company more attractive for investment. It’s the language investors speak.

- Long-Term Strategy: ARR provides a long-term perspective on your revenue, helping you identify trends, assess the sustainability of your growth, and make strategic decisions for the future. It's your roadmap to long-term success.

Calculating ARR

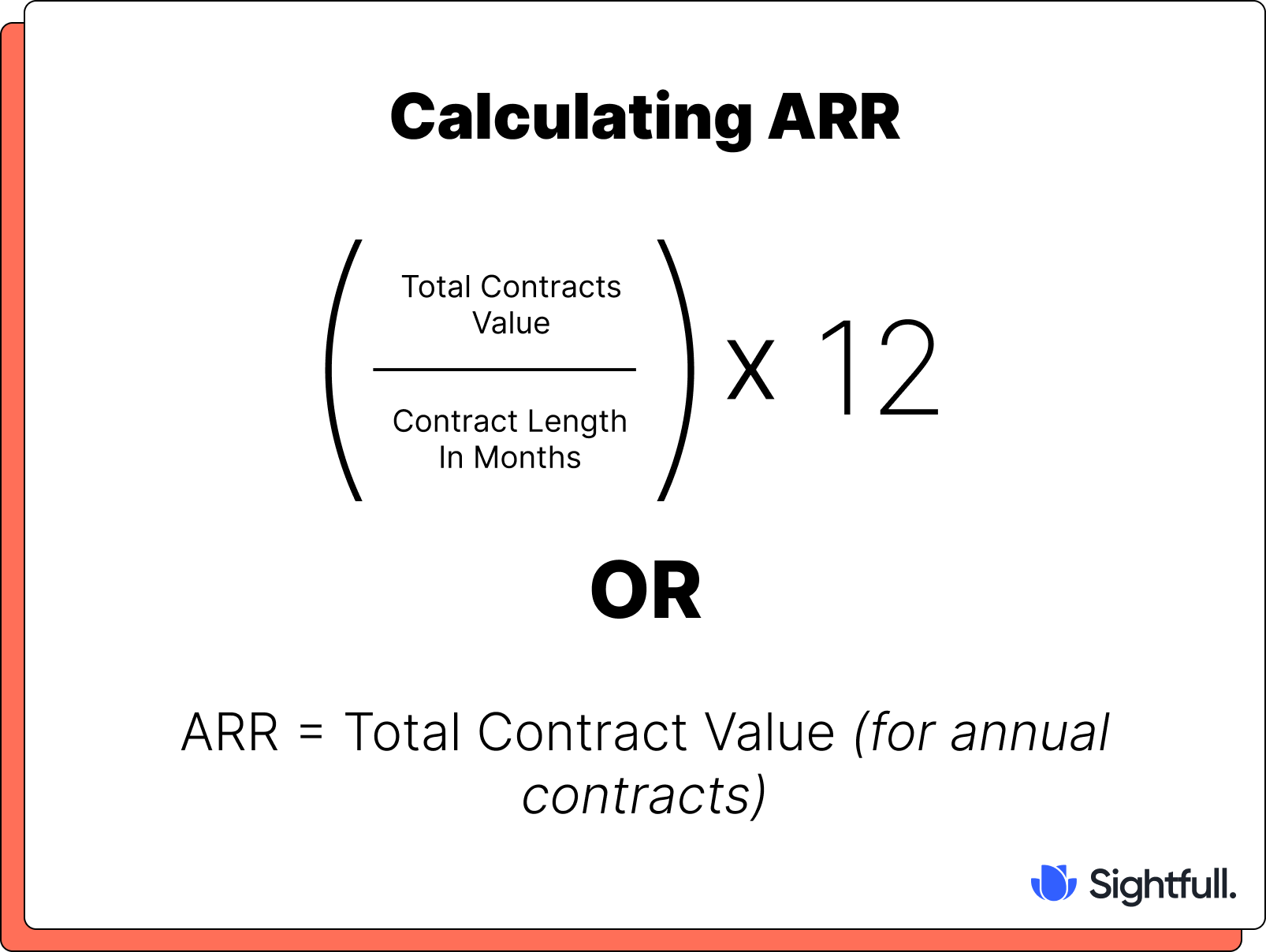

The formula for calculating ARR depends on your billing cycle:

- Monthly Subscriptions: ARR = (Total contract value / Contract length in months) * 12

- Annual Contracts: ARR = Total contract value

Example:

- A 2-year contract worth $20,000 has an ARR of $10,000.

- A 1-year contract worth $5,000 has an ARR of $5,000.

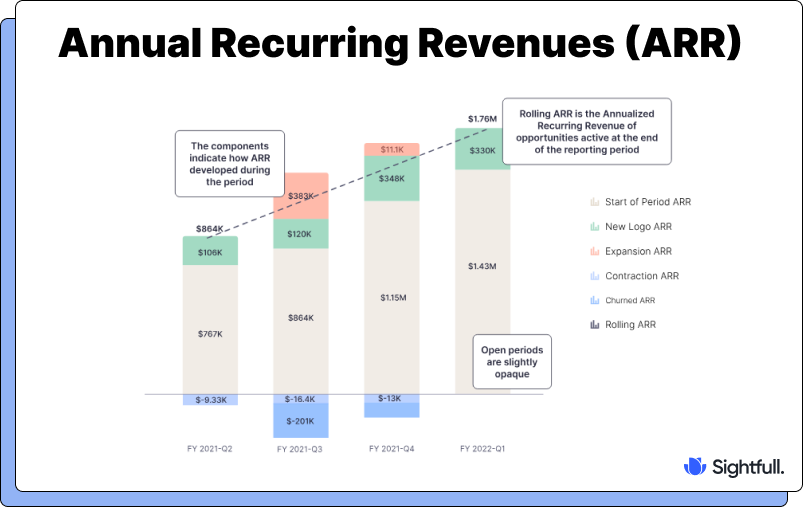

Tracking ARR

Platforms like Sightfull offer automated ARR calculations and visually engaging dashboards so you can easily monitor your ARR growth over time. No more spreadsheets, just clear, concise visuals.

Potential Pitfalls

- One-Time Fees: Don’t include one-time fees like setup fees or implementation costs in your ARR calculation. ARR should only reflect recurring revenue. This is about predictable revenue, the kind you can count on.

- Churn and Downgrades: Churn and downgrades can significantly impact ARR. Track these metrics closely and factor them into your ARR calculations for a more accurate picture of your revenue growth. Don’t ignore the leaky bucket.

- Expansions: Expansions (upsells and cross-sells to existing customers) contribute to ARR growth. Make sure to include these in your calculations. Growth comes from both new and existing customers.

Monthly Recurring Revenue (MRR): Your Short-Term Pulse

MRR is ARR’s younger brother, or sister? I Haven't really decided yet if ARR is a he or a she or a they. It measures your recurring revenue on a monthly basis. It’s the pulse of your business, giving you a more granular view of your revenue flow and allowing you to quickly identify short-term trends. It’s your finger on the pulse of your business.

Why MRR Matters

- Short-Term Performance: MRR provides a snapshot of your monthly revenue performance, allowing you to quickly identify any dips or spikes and make adjustments to your sales and marketing strategies. It’s your early warning system.

- Trend Analysis: Tracking MRR month over month helps you identify trends and patterns in your revenue growth, giving you valuable insights for forecasting and planning. It’s your trend-spotting tool.

- Cash Flow Management: MRR gives you a clearer picture of your short-term cash flow, enabling you to manage expenses and make informed financial decisions. It’s your cash flow compass.

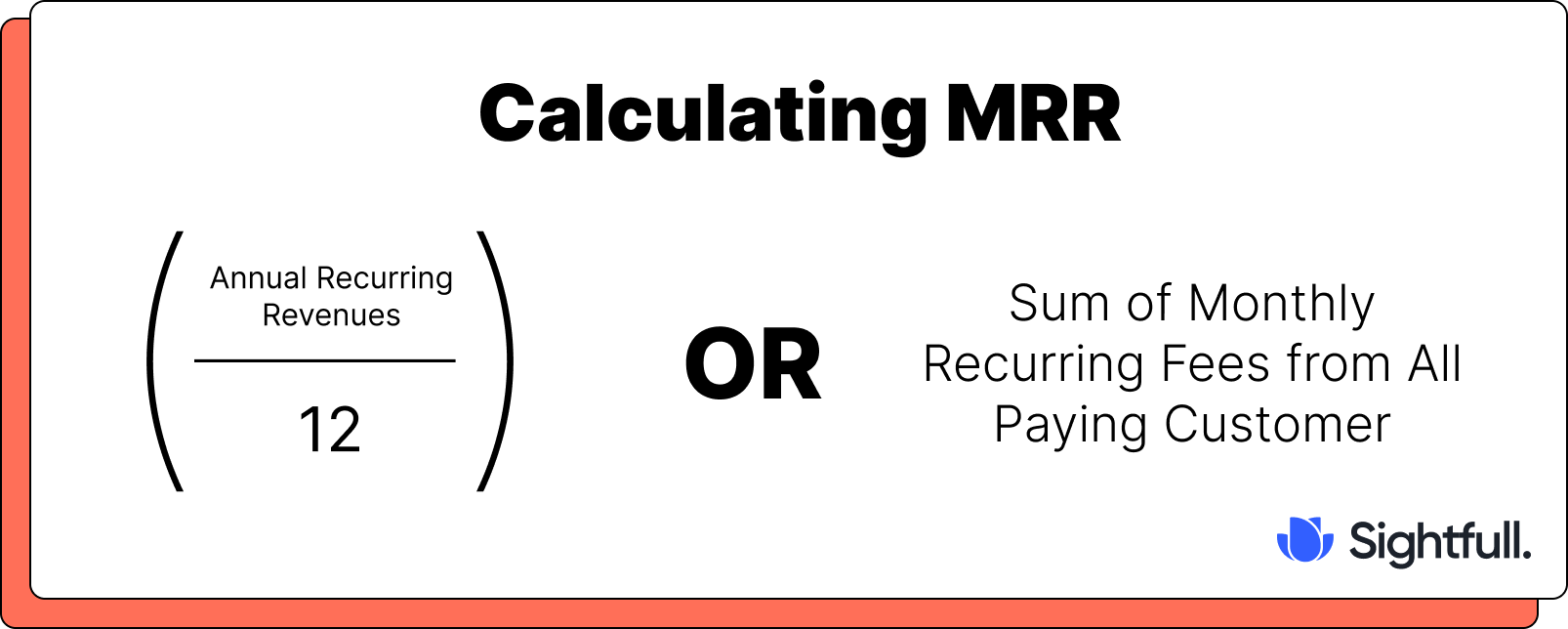

Calculating MRR

The easiest way to calculate MRR is: MRR = ARR / 12. You can also calculate MRR by summing the monthly recurring fees from all your paying customers. Simple as that.

Tracking MRR

Tools like Sightfull allow you to automatically track MRR and visualize your progress. No more manual calculations, just clear, concise data.

Potential Pitfalls

- Confusing MRR with Bookings: Bookings include one-time fees, while MRR should only reflect recurring revenue. Make sure you’re comparing apples to apples.

- Fluctuations: MRR can fluctuate month to month due to seasonality or other short-term factors. Analyze trends over longer periods to get a more accurate picture of your revenue growth. Don't overreact to short-term noise.

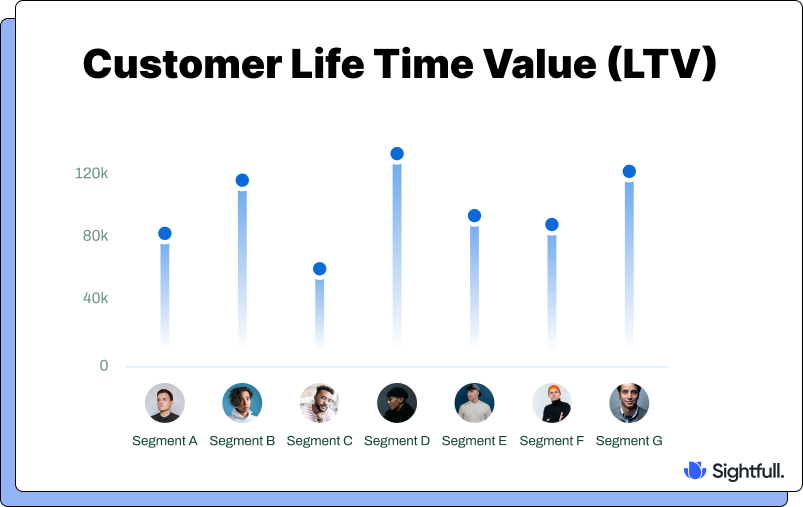

Customer Lifetime Value (CLTV/LTV): Maximizing Customer Relationships

CLTV? Think of it as your crystal ball for customer revenue. It predicts the total revenue you can rake in from a single customer over their entire relationship with your business. It's all about looking ahead, understanding how much value you're really getting from acquiring and keeping those loyal customers around. This is about playing the long game.

Why CLTV Matters

- Strategic Investments: CLTV helps you make informed decisions about how much to invest in acquiring and retaining customers. Knowing the potential lifetime value of a customer lets you optimize your marketing and sales spend. It’s about getting the most bang for your buck.

- Pricing Strategies: CLTV can inform your pricing strategy. A higher CLTV might justify higher prices, while a lower CLTV might suggest you need to be more competitive. It's about finding the sweet spot.

- Customer Retention: A high CLTV emphasizes the importance of keeping your customers happy. Retaining customers for longer periods increases their lifetime value and contributes to sustainable growth. It’s about building lasting relationships.

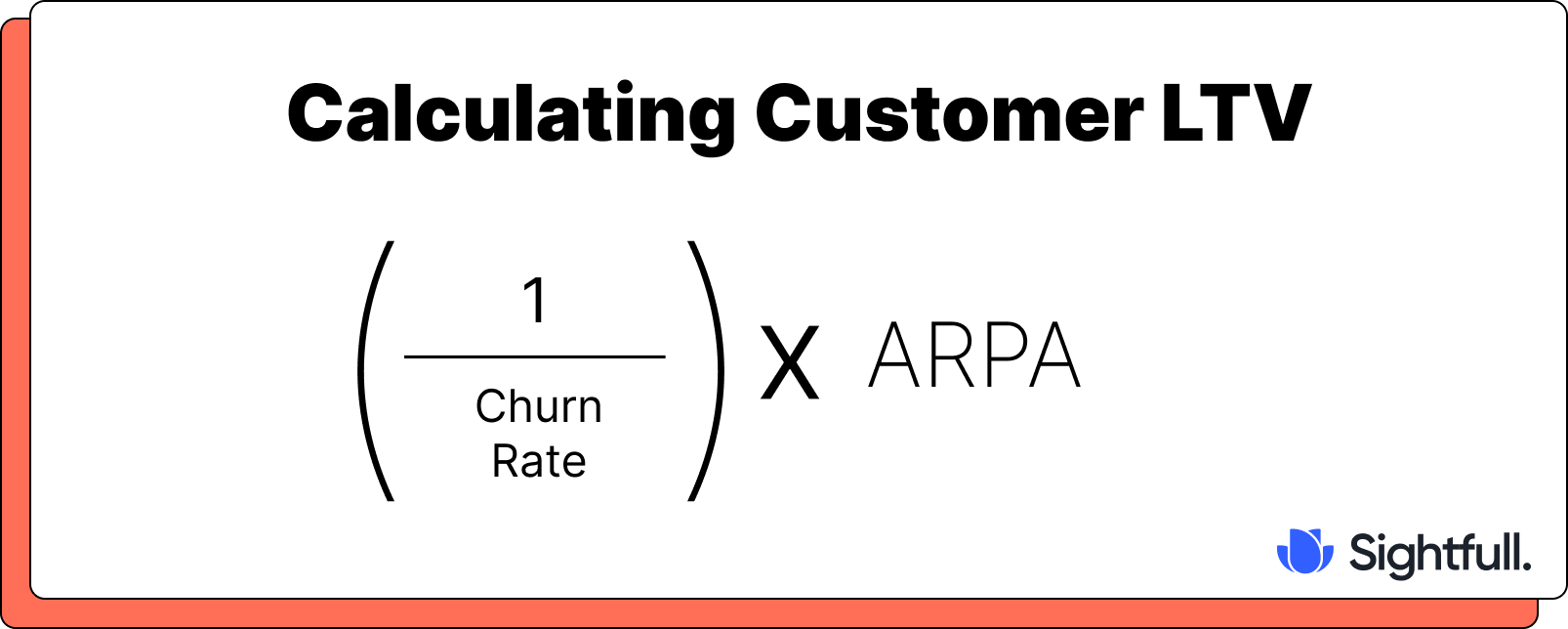

Calculating CLTV

There are several ways to calculate CLTV, with varying levels of complexity. A simple formula is:

CLTV = (1 / Churn rate) * ARPA.

Example

If your average monthly churn rate is 5% and your average revenue per account (ARPA) is $100, then your CLTV is $2,000.

Tracking CLTV

Sightfull and other analytics tools can help you track CLTV and visualize how it changes over time. It’s about keeping your finger on the pulse of customer value.

Potential Pitfalls

- Ignoring Churn: Failing to account for customer churn can lead to an overestimation of CLTV. Make sure churn is part of your calculation. Don’t ignore the leaky bucket.

- Varying ARPA: ARPA can vary across different customer segments. Consider segmenting your CLTV calculations to get a more granular view of customer value. Not all customers are created equal.

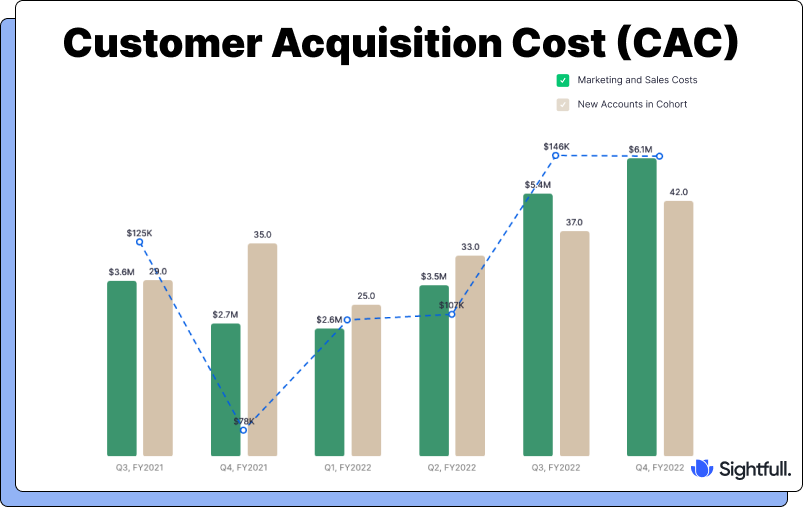

Customer Acquisition Cost (CAC): Investing Wisely in Growth

CAC – how much does it actually cost to bring in one new customer? It’s the total cost, soup to nuts: marketing, sales, onboarding, the whole shebang. Knowing your CAC is crucial for understanding just how much that growth is costing you.

Why CAC Matters

- Profitability: CAC is essential for understanding your profitability. A low CAC means you’re acquiring customers efficiently, while a high CAC can eat into your profit margins. It’s about making sure your growth is sustainable.

- Marketing ROI: CAC helps you evaluate the return on investment (ROI) of your marketing efforts. By tracking CAC against customer lifetime value (CLTV), you can determine if your marketing spend is generating a positive return. It’s about making sure your marketing is working.

- Sales Efficiency: CAC can indicate the efficiency of your sales process. A high CAC might suggest you need to improve your sales funnel or lead qualification process. It’s about optimizing your sales machine.

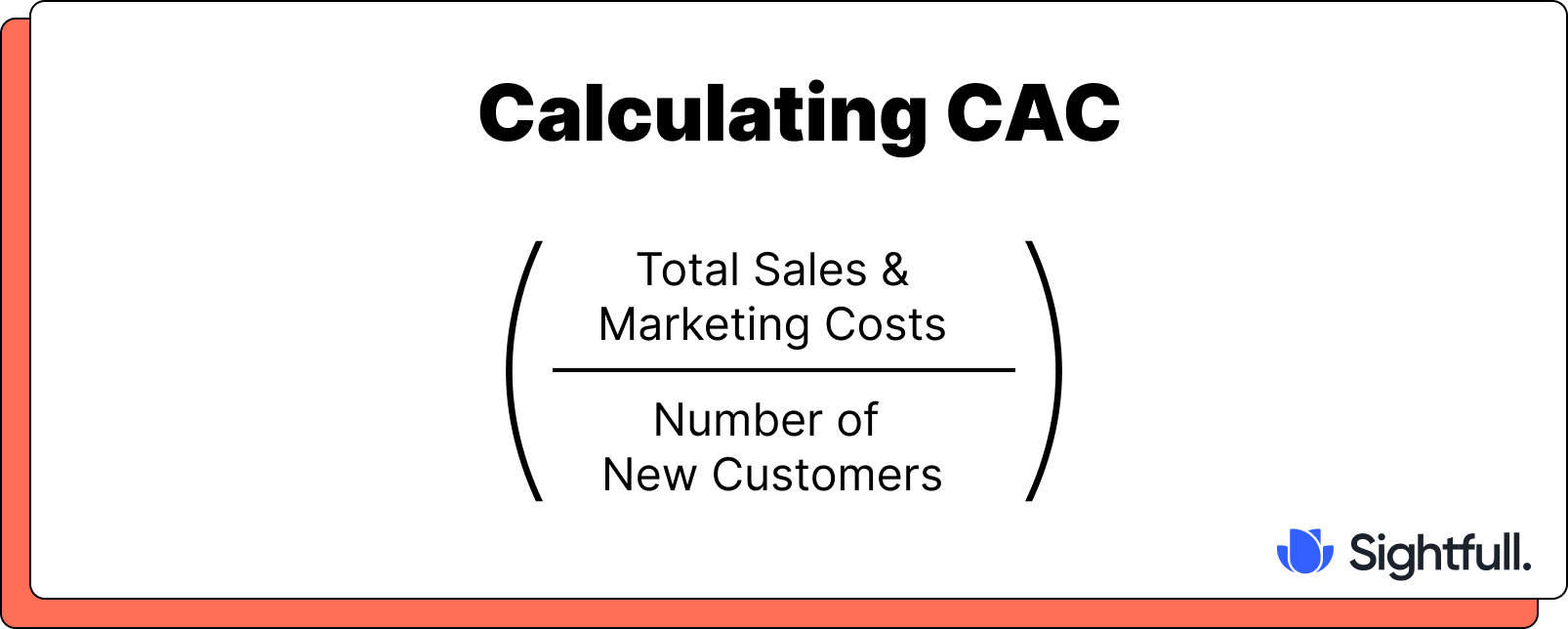

Calculating CAC

CAC = (Total Sales & Marketing Costs) / (Number of New Customers).

Example:

If you spend $10,000 on sales and marketing in a month and acquire 100 new customers, then your CAC is $100.

Tracking CAC

Sightfull lets you track CAC and visualize how it changes over time, segmented by channels and campaigns. It's about understanding where your money is going and what’s working.

Potential Pitfalls

- Hidden Costs: Make sure to include all costs associated with customer acquisition, including overhead, salaries, and software expenses. Don’t underestimate your true CAC.

- Channel Attribution: Attributing costs to the correct marketing channels can be tricky. Use appropriate attribution models to accurately track your spending and calculate CAC by channel. Know where your most valuable customers are coming from.

CAC Payback Period: The Clock is Ticking

The CAC Payback Period tells you how long it takes to recoup the cost of acquiring a customer. It’s a measure of how quickly your investment in customer acquisition starts generating a positive return. Time is money.

Why CAC Payback Matters

- Cash Flow: A shorter payback period means you’re recovering your acquisition costs faster, improving your cash flow and freeing up resources to invest in other areas of your business. It's about keeping the engine running.

- Investment Efficiency: A shorter payback period means a more efficient customer acquisition process. You’re getting a quicker return on your investment, maximizing the impact of your marketing and sales spend. It’s about working smarter, not harder.

- Financial Health: The CAC payback period is an indicator of your overall financial health. A longer payback period might suggest inefficiencies in your sales process or a need to adjust your pricing strategy. It's a health check for your business.

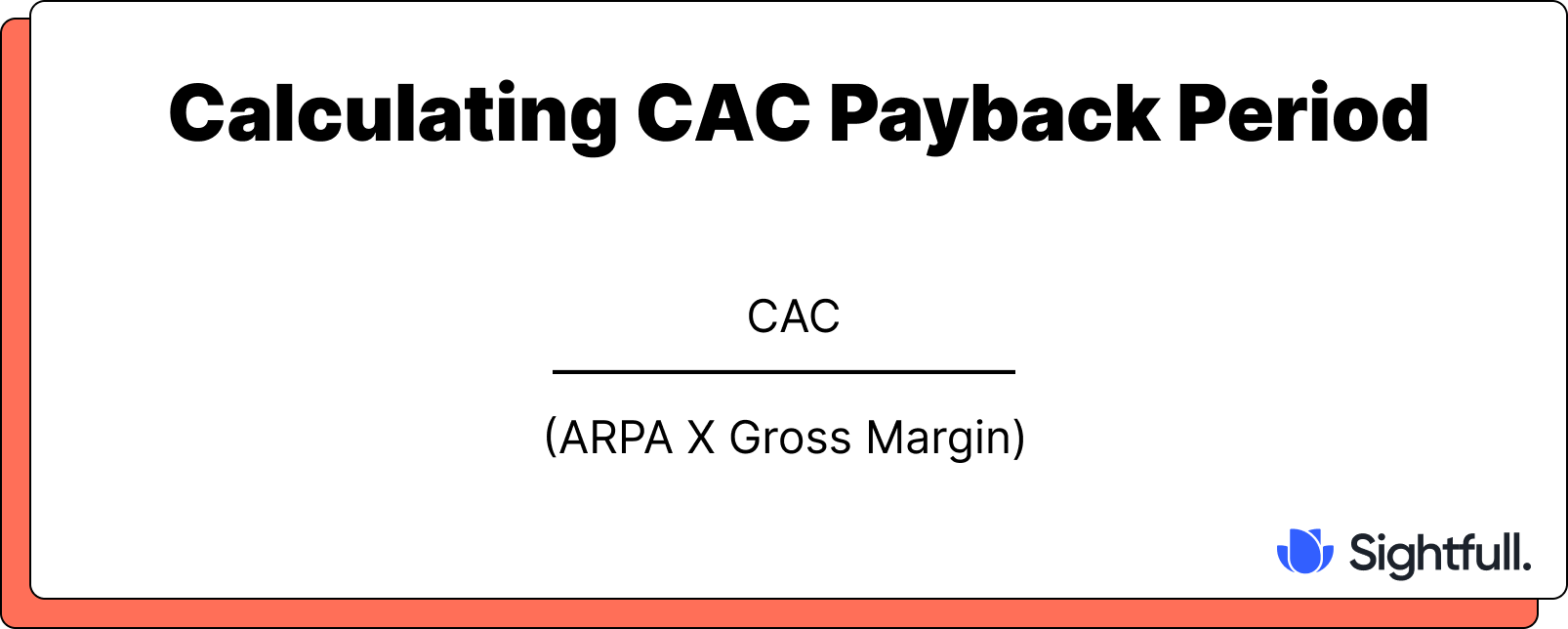

Calculating CAC Payback

CAC Payback Period = CAC / (ARPA * Gross Margin)

Example:

If your CAC is $200, your ARPA is $50, and your gross margin is 70%, then your CAC payback period is approximately 5.7 months.

Tracking CAC Payback

You can track CAC payback period using financial modeling tools, including Sightfull, which lets you monitor this metric and identify trends. It's about staying on top of your financial performance.

Potential Pitfalls

- Short-Term Focus: Don't get so fixated on a short payback period that you neglect the long-term value of customers. Acquiring customers with lower LTV for the sake of a quick payback can hurt long-term growth. It’s about playing the long game.

- Ignoring LTV: Consider CAC payback period in conjunction with CLTV. A short payback period with low LTV customers isn’t as good as a longer payback period with high LTV customers. It’s about quality over quantity.

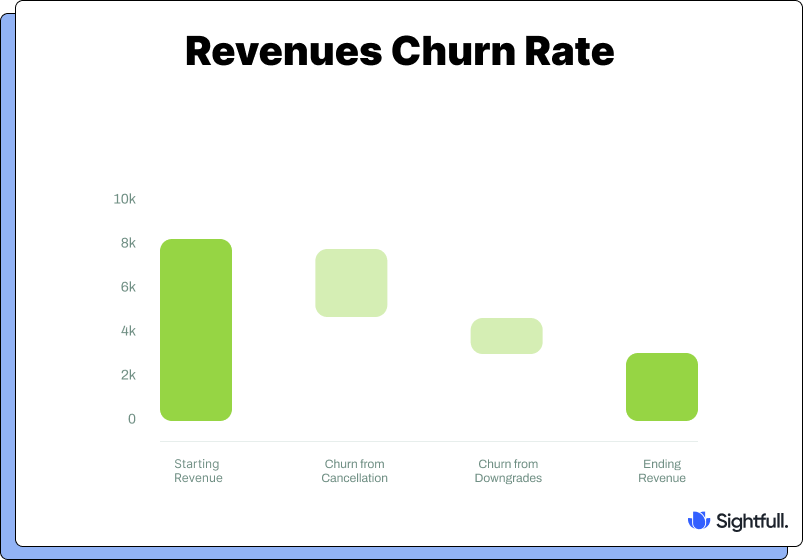

Revenue Churn Rate: Plugging the Leaky Bucket

Revenue churn rate (also known as MRR churn rate) is the percentage of recurring revenue you lose each month due to customer cancellations and downgrades. It tells you how well you’re retaining your existing customer base and their revenue. It’s about holding onto what you’ve earned.

Why Revenue Churn Matters

- Growth: High revenue churn makes it harder to grow. Losing recurring revenue every month makes it tougher to scale your business and hit your financial goals. It's like trying to fill a leaky bucket.

- Customer Satisfaction: High revenue churn can be a sign of underlying issues with customer satisfaction or product-market fit. Losing customers and their revenue suggests you might need to address their pain points or improve your product. It’s a wake-up call.

- Forecasting: Revenue churn is crucial for revenue forecasting. To accurately predict future revenue, you need to understand how much recurring revenue you’re likely to lose each month. It's about realistic expectations.

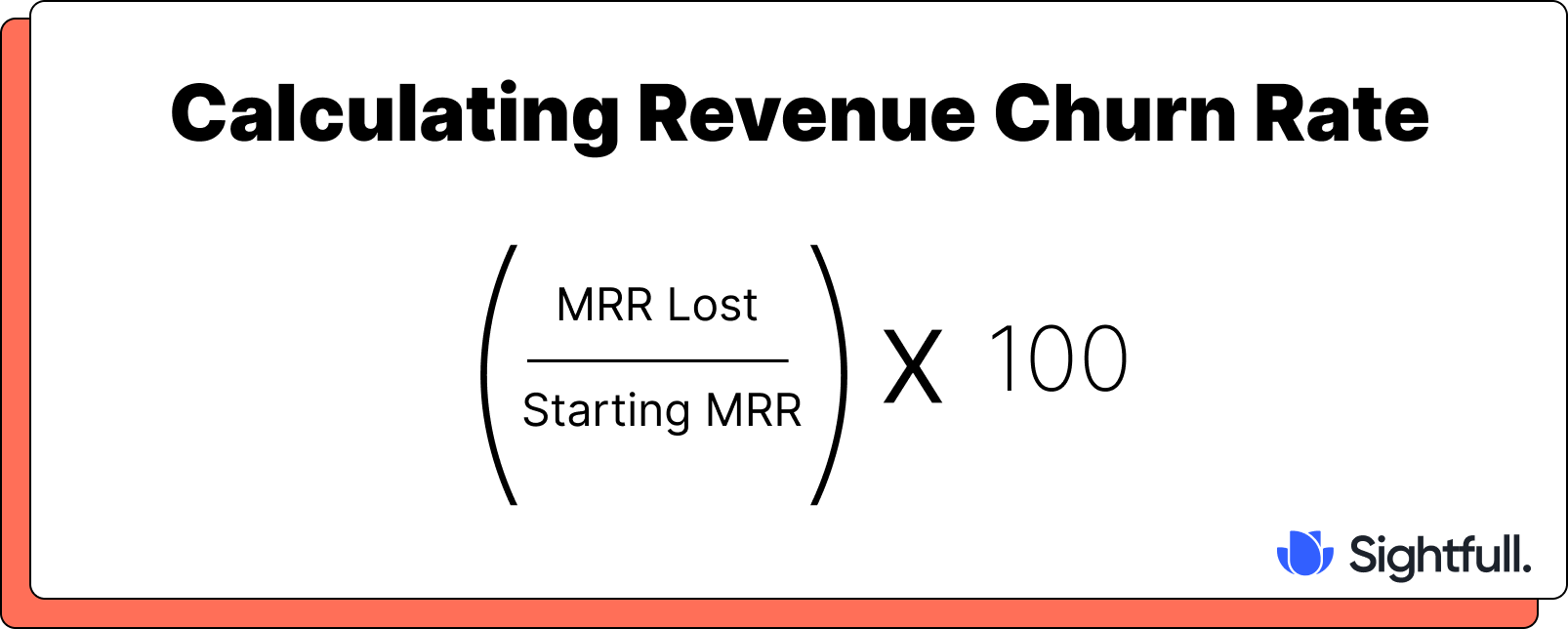

Calculating Revenue Churn

Revenue Churn Rate = (MRR lost) / (Starting MRR) * 100

Example:

If you start the month with $100,000 in MRR and lose $5,000 due to churn, then your revenue churn rate is 5%.

Tracking Revenue Churn

Sightfull and other analytics tools can help you track revenue churn and segment it by customer cohorts, plans, and other factors to identify trends and areas for improvement. It’s about understanding why customers are leaving.

Potential Pitfalls

- Ignoring Downgrades: Revenue churn includes both cancellations and downgrades. Ignoring downgrades underestimates your true churn and can create a false sense of security. Don’t sugarcoat the numbers.

- Focusing on Customer Churn: While customer churn is important, revenue churn provides a more complete picture of the financial impact of lost customers. Focus on both metrics to understand the full impact of churn. It’s about the bottom line.

Revenue Growth Rate: The Engine of Your Success

Revenue growth rate is the percentage increase or decrease in your revenue over a specific period, typically measured month-over-month or year-over-year. It’s a fundamental indicator of your business's growth trajectory. It’s the engine that drives your B2B SaaS business forward.

Why Revenue Growth Matters

- Business Health: Revenue growth is a key indicator of your overall business health and success. A healthy growth rate signifies strong demand for your product or service and a well-executed go-to-market strategy. It’s a sign that you’re doing something right.

- Investor Confidence: Revenue growth is a primary factor that investors look at when evaluating a business. Strong and sustainable growth attracts investment and increases your company's valuation. It’s what gets investors excited.

- Market Share: Revenue growth can indicate your ability to gain market share and outperform your competitors. A higher growth rate often translates to a bigger slice of the market pie. It’s about winning in the marketplace.

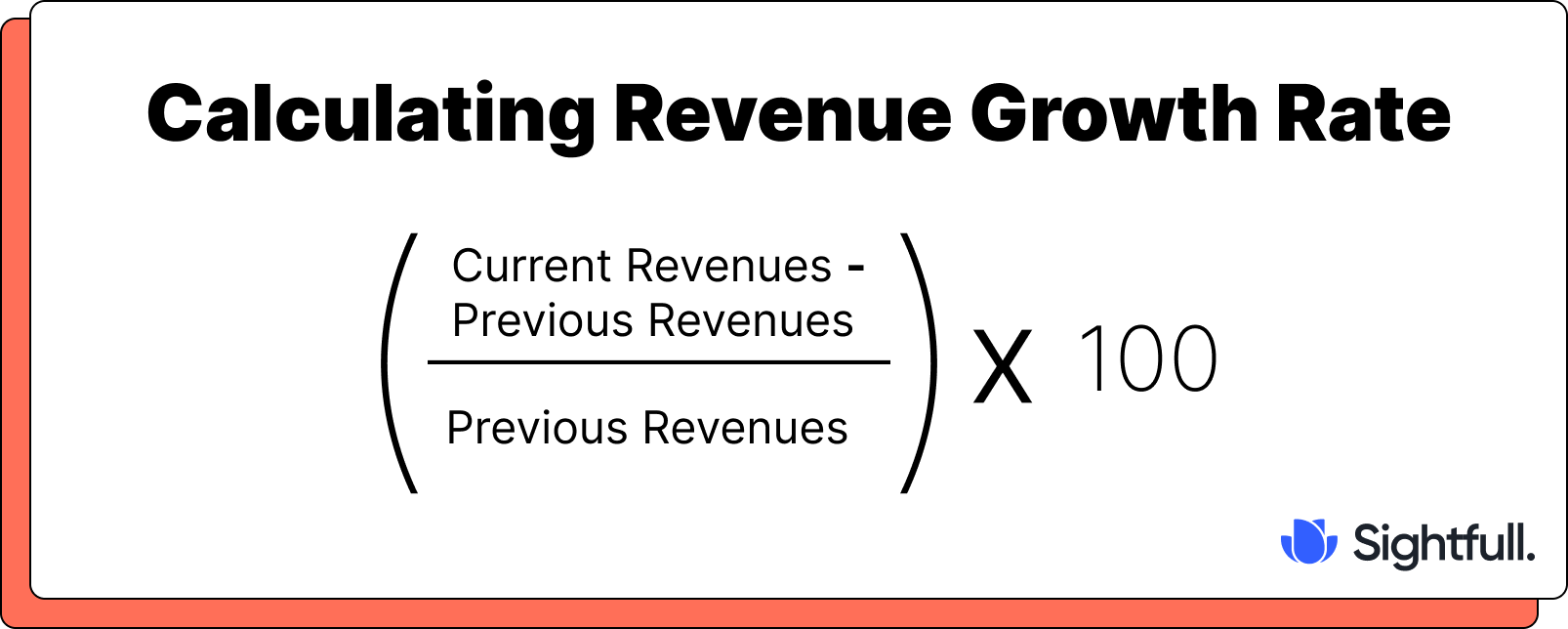

Calculating Revenue Growth

Revenue Growth Rate = ((Current Revenue - Previous Revenue) / Previous Revenue) * 100

Example:

If your revenue this month is $120,000 and your revenue last month was $100,000, then your revenue growth rate is 20%.

Tracking Revenue Growth

Track your revenue growth using financial reporting tools and visualize your progress with bar graphs or line charts, highlighting growth periods and trends. Sightfull offers interactive dashboards and automated reporting to streamline this process. It’s about making data visualization easy.

Potential Pitfalls

- Ignoring Profitability: Chasing revenue growth at all costs can be detrimental to your business's long-term sustainability. You need to balance revenue growth with profitability. It’s about building a sustainable business.

- Unsustainable Growth: Rapid revenue growth that isn't built on a solid foundation can be unsustainable. Make sure your growth is driven by efficient processes, strong customer retention, and a scalable business model. It’s about building for the long haul.

Wrapping Up

Boom! You've officially conquered the world of Revenue & Growth KPIs. You're no longer intimidated by acronyms; you're wielding them like a pro.

ARR, MRR, CLTV—they're all part of your data-driven arsenal now. This knowledge is your GTM compass, pointing you towards sustainable growth and smart decision-making.

But the journey doesn't end here. In Part 2, we're diving into the nitty-gritty of Marketing KPIs—the engine that drives customer acquisition, engagement, and those sweet, sweet conversions. Get ready to turn data into dollars.

Get your free guide to ARR calculations.

FAQ

Ready to Elevate Your B2B SaaS KPIs?

Transform your KPIs into growth drivers with Sightfull

On-demand Webinar!

Watch this webinar to hear from Noam Liran, Sightfull's CEO and co-founder on how to drive revenue growth at scale from leads to renewals.