What is Annual Recurring Revenue (ARR) and How to Calculate it?

Understanding how to calculate Annual Recurring Revenue (ARR) is essential for any subscription-based business. ARR provides a clear picture of predictable, recurring revenue, which is crucial for evaluating a company’s financial stability and growth prospects. This metric allows businesses to forecast future income, plan budgets, and make strategic decisions based on reliable financial data.

What is Annual Recurring Revenue (ARR)?

Annual Recurring Revenue (ARR) is a key metric in subscription-based business models, representing the annualized value of the recurring revenue generated from active customer subscriptions. This predictable revenue is essential for evaluating a company’s long-term financial health. What is ARR in business? ARR gives insight into the stability of a company’s revenue stream by excluding non-recurring items like one-time setup fees or hardware sales.

In simpler terms, ARR reflects the revenue a company can expect annually from its recurring customer base, offering a clear view of growth potential. Tracking ARR revenue is crucial for companies aiming for financial stability and scalability, particularly in industries like SaaS where recurring payments are the norm.

Why Is ARR Important?

ARR is critical for any business that operates on a subscription model. Measuring annual recurring revenue provides a clear picture of a company’s future cash flow and overall financial health.

Here’s why ARR matters:

- Financial Stability and Forecasting: ARR allows businesses to predict their revenue streams for the year, enabling better financial planning. In ARR finance, it is a key metric used to assess the growth trajectory and overall profitability of the company.

- Customer Retention and Growth: By monitoring ARR retention, businesses can track how well they are keeping existing customers and expanding their relationships. Increasing ARR often depends on reducing churn and upselling existing customers.

- Attracting Investors and Securing Loans: Investors and financial institutions often rely on annual recurring revenue loans to evaluate the stability and creditworthiness of a business. A consistently growing ARR makes a business more attractive for investment and easier to finance.

How to Calculate Annual Recurring Revenue (ARR)

Calculating Annual Recurring Revenue (ARR) is essential for businesses relying on subscription-based models, like SaaS, to understand their predictable, recurring income. To calculate ARR correctly, it’s important to distinguish recurring payments from non-recurring ones, and recognize the difference between Total Contract Value (TCV) and ARR.

Steps to Correctly Calculate ARR

Identify Recurring Revenue:

Focus on recurring payments such as subscription fees. Exclude any non-recurring payments like setup fees or hardware sales.

Understand TCV vs. ARR:

Total Contract Value (TCV) includes all revenue from a contract, but ARR only accounts for the recurring revenue portion. Always exclude one-time fees when calculating ARR.

Calculate Monthly Recurring Revenue (MRR):

Divide the Total Contract Value (TCV) by the length of the contract (in months) to get the Monthly Recurring Revenue (MRR).

MRR = Total Contract Value (TCV) ÷ Contract Length (months)

Annualize the Recurring Revenue:

Multiply MRR by 12 to get Annual Recurring Revenue (ARR).

ARR = MRR × 12

ARR Calculation Examples

SaaS Company with Monthly Subscriptions

If a SaaS company has a Total Contract Value (TCV) of $1,200,000 from contracts lasting 12 months, the MRR is calculated as:

MRR = 1,200,000 ÷ 12 = 100,000

To calculate ARR:

ARR = 100,000 × 12 = 1,200,000

Company with Annual Contracts

For a company with a TCV of $300,000 over 24 months, the MRR would be:

MRR = 300,000 ÷ 24 = 12,500

To convert MRR to ARR:

ARR = 12,500 × 12 = 150,000

Additional Considerations

- Non-Standard Billing Cycles: If you have non-standard billing cycles (e.g., quarterly or bi-annual), ensure that you adjust your calculations accordingly to arrive at the correct ARR.

- Churn and Downgrades: Keep in mind that ARR will fluctuate over time due to churn (customers canceling their subscriptions) and downgrades (customers moving to lower subscription tiers). These subtractions should be factored in to provide an accurate, ongoing calculation of ARR finance.

Accurately calculating ARR helps businesses forecast future revenue, make informed strategic decisions, and track growth over time. By focusing on the recurring revenue from active subscriptions and using the correct ARR calculation formula, companies can ensure they have a clear, actionable view of their predictable income.

Key Components of ARR

Annual Recurring Revenue (ARR) is dynamic, changing over time as new customers are acquired, existing customers expand or downgrade, and some accounts churn. Understanding these changes through the components of the ARR waterfall helps businesses track the fluctuations in their ARR revenue and make informed decisions. Here are the core components of ARR:

- New Customer Revenue: This includes revenue from customers who signed up within the current period, contributing to new logo ARR. New customer additions provide a clear measure of business growth and are essential for expanding your ARR revenue. Tracking new ARR helps assess the effectiveness of acquisition strategies.

- Expansion Revenue: Expansion ARR reflects the additional revenue generated from existing customers through upselling or cross-selling higher-tier services or complementary products. This component highlights the value of customer loyalty and engagement, as well as the success of retention and ARR pricing strategies. Expanding current accounts can significantly boost ARR finance.

- Retained ARR: Retained ARR represents the recurring revenue retained from your existing customer base at the start of the period being analyzed. This is critical for understanding how much of the ARR revenue comes from the foundation of loyal, recurring customers, ensuring stability in your business.

- Contraction (Downgrade): Contraction occurs when customers reduce their spending by downgrading their service plans. This reduction negatively impacts ARR and signals that some customers may not be realizing the full value of your product. Monitoring ARR contraction helps identify areas for improvement in service delivery or ARR pricing optimization.

- Churn (Lost Customers): Churned ARR refers to the revenue lost when customers cancel their subscriptions entirely. High churn rates can erode the positive gains from new and expanding customers, significantly affecting the company’s ARR finance and growth potential. Reducing churn is critical for sustaining and growing ARR revenue.

By tracking these components, businesses can visualize the flow of their ARR, identifying both the growth drivers (new customers and expansions) and the risks (contractions and churn). This ARR calculation approach offers an accurate, ongoing view of how revenue is developing over time, enabling more effective forecasting and planning.

What is the Difference Between ARR and MRR?

What is ARR in sales versus MRR? While ARR represents the total annualized revenue, MRR focuses on monthly revenue. ARR is generally used for long-term planning and investment analysis, while MRR helps businesses with monthly subscription models track short-term performance.

- Use ARR for Long-Term Growth: ARR gives a broader view of financial health, ideal for businesses with yearly contracts.

- Use MRR for Short-Term Planning: MRR helps businesses adjust sales and marketing efforts in the short term, offering quicker feedback on strategies.

How to increase ARR?

Growing ARR is crucial for subscription businesses. Here are some proven strategies:

- Customer Retention: Reducing churn is key to maintaining and growing ARR. Focus on delivering consistent value and improving customer support to retain customers.

- Upsell and Cross-Sell: Offering higher-tier services or complementary products to existing customers boosts ARR revenue through Expansion ARR.

- Expand into New Markets: Penetrating new markets can drive new logo ARR and significantly increase overall recurring revenue.

Ways to Optimize Your ARR

Optimizing Annual Recurring Revenue (ARR) is not just about improving pricing or acquiring new customers—it's about having full visibility into your ARR metrics and understanding how these metrics evolve over time. This helps to uncover potential risks, such as churn and contraction, and highlight opportunities for expansion and acquiring new customers. Here are key strategies for optimizing ARR:

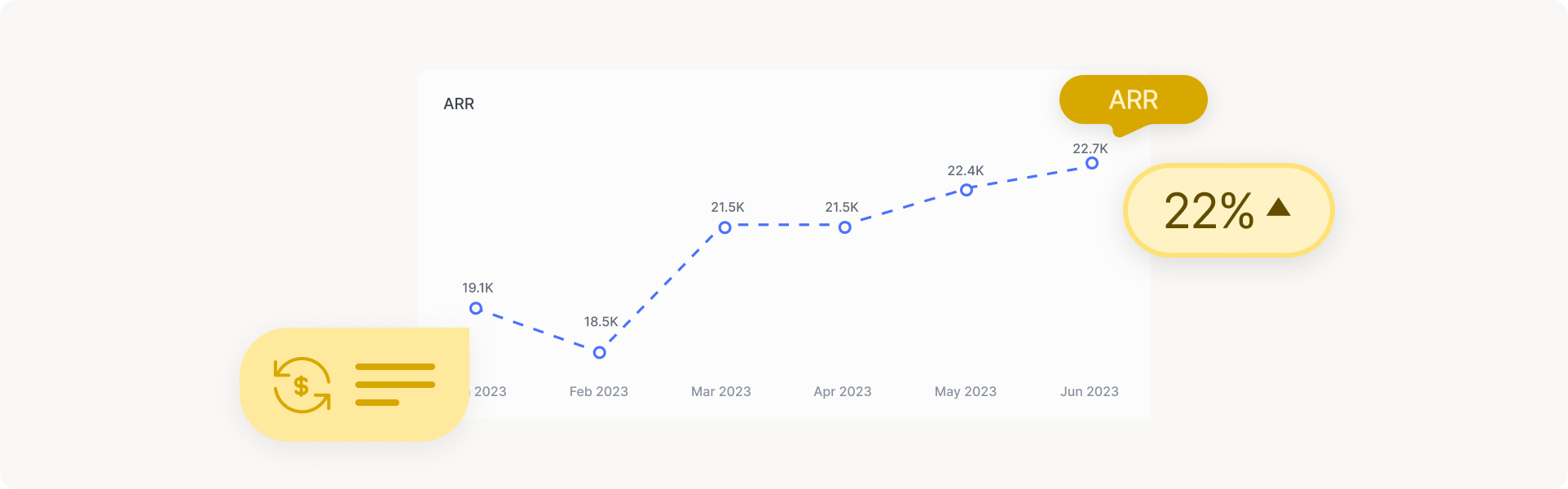

Track and Analyze ARR Over Time

Visibility into your ARR is crucial for understanding how your recurring revenue changes over different periods. Accurate, real-time ARR tracking allows you to see fluctuations in new customer revenue, expansion ARR, and churn, enabling you to address potential issues before they impact your business.

- Why it matters: Without an accurate picture of how ARR evolves, businesses risk missing out on key trends, such as sudden increases in churn or opportunities for upselling. Tracking these changes ensures proactive decision-making rather than reactive damage control.

- Actionable Tip: Use CRM tools like Salesforce or HubSpot to create dashboards that track ARR trends, including customer renewals, downgrades, and upgrades. Set up automated alerts for when churn or contraction spikes, giving you real-time insights into potential “leaky buckets” where revenue is being lost.

Identify and Plug "Leaky Buckets" of Churn and Contraction

One of the most significant barriers to ARR optimization is churn—customers who cancel their subscriptions—and contraction, where customers downgrade their plans. These losses can have a substantial impact on the business, eroding gains from new and expanding customers.

- Why it matters: High churn and contraction rates are symptoms of deeper issues, such as customer dissatisfaction or misaligned product offerings. By identifying the root causes of churn, businesses can address customer pain points and improve retention.

- Actionable Tip: Conduct churn analysis by segmenting customers who left or downgraded their services and gathering feedback to understand their reasons. Implement retention strategies, such as personalized customer support, loyalty programs, and proactive check-ins to reduce ARR contraction.

Leverage Expansion Opportunities

Expansion ARR—revenue generated from existing customers upgrading or purchasing additional services—is a powerful driver of growth. By nurturing your existing customer base, you can significantly increase ARR without having to rely solely on acquiring new customers.

- Why it matters: Expanding existing accounts is more cost-effective than acquiring new ones. Additionally, customers who expand their usage tend to be more loyal and have a higher lifetime value, making them key to long-term success.

- Actionable Tip: Use your CRM to track customers' product usage and identify opportunities for upselling or cross-selling. For example, if a customer is consistently using 80% of their allocated bandwidth, it may be the right time to offer them an upgrade. Automated marketing campaigns can also help target existing customers with personalized offers for expansion.

Refine Pricing Strategies

Effective ARR pricing strategies are essential for maximizing revenue potential across different customer segments. Tiered pricing models that offer varying levels of service, from basic to premium, allow businesses to cater to a wider audience and encourage upgrades.

- Why it matters: A well-structured pricing model can improve ARR retention by offering customers flexible options that suit their evolving needs. It also helps capture more revenue from customers who are willing to pay for advanced features.

- Actionable Tip: Consider implementing tiered pricing models with clear differentiation between service levels. Offer entry-level plans to attract new customers while providing premium tiers that cater to power users who require advanced features. A/B testing different pricing structures can help you identify the model that maximizes revenue while maintaining customer satisfaction.

Use Automation Tools to Track and Optimize ARR

Automation tools play a vital role in streamlining ARR tracking and optimizing business processes related to customer engagement, upselling, and retention. CRMs like Salesforce, HubSpot, and Zoho enable businesses to automatically track customer interactions, identify trends in ARR growth, and uncover opportunities to improve performance.

- Why it matters: Without automation, tracking changes in ARR manually can be time-consuming and error-prone. Automation helps businesses stay on top of customer data, reduce churn, and make data-driven decisions to enhance ARR revenue.

- Actionable Tip: Automate follow-up emails and renewal reminders to ensure customer engagement remains strong. Additionally, use automated alerts to notify your team when a customer is close to churning, allowing for timely intervention with retention strategies.

Focus on Customer Engagement and Retention

Customer engagement is a key factor in maintaining and growing your ARR. Regular check-ins, personalized communication, and proactive customer support can significantly reduce churn and improve ARR retention. Engaged customers are more likely to renew their contracts and consider upgrading their services, directly contributing to expansion ARR.

- Why it matters: Engaged customers are more likely to stay with your service and upgrade over time. Poor engagement, on the other hand, often leads to increased churn and lost revenue opportunities.

- Actionable Tip: Develop a customer engagement plan that includes personalized outreach, regular product usage check-ins, and satisfaction surveys. Tools like Intercom or Zendesk can help automate customer interaction and support, ensuring no customer is left behind.

Why is ARR Important for Your Business?

ARR is one of the most important indicators of a company’s financial health, particularly in the SaaS and subscription-based industries. It provides a clear, predictable picture of recurring revenue, helping businesses:

- Gauge Financial Health: ARR shows how much revenue a company can expect, making it a vital metric for long-term financial planning.

- Attract Investors: Strong ARR growth indicates stability and scalability, which can attract investors and increase access to annual recurring revenue loans.

- Plan for Future Growth: By tracking ARR, businesses can forecast revenue, allocate resources more effectively, and plan for sustainable long-term growth.

Conclusion: Maximizing ARR for Sustainable Growth

In the rapidly evolving world of subscription-based businesses, Annual Recurring Revenue (ARR) is one of the most crucial metrics for long-term success. Understanding what is ARR, accurately calculating it, and tracking its fluctuations over time provide a solid foundation for financial stability and growth. This guide has emphasized the importance of visibility into your ARR revenue, the critical components that drive ARR growth—including new customer acquisition, expansion ARR, and churn management—and the various strategies to optimize these elements.

To truly optimize your ARR:

- Accurately track and analyze your ARR across different periods to identify "leaky buckets" where churn and contraction are impacting your revenue.

- Leverage expansion opportunities by upselling existing customers and refining your pricing models to cater to diverse customer needs.

- Reduce churn through personalized customer engagement, proactive support, and retention strategies, ensuring steady growth and long-term customer satisfaction.

By applying the insights and strategies outlined in this guide—including ARR pricing, customer retention, and automation tools—businesses can maximize their ARR and position themselves for continued profitability and sustainable growth. With a clear understanding of how to calculate ARR and a strategic approach, your business will be better equipped to scale effectively in the subscription economy.

All the SaaS revenue metrics you need

ARR is only one of the hundreds of SaaS metrics that are available out-of-the-box to users of the Sightfull revenue analysis and optimization platform. They include all the critical metrics required for SaaS companies - from indicators regarding campaigns and leads, through those that track pipeline, conversion and bookings, and all the way to later signals such as retention and expansion.

These highly precise customizable metrics are automatically calculated based on a large repository of SaaS industry standards, best practices and benchmarks. This saves lots of time for RevOps teams since they don’t have to rely on data analysts for support, waste time on error-prone spreadsheets, or manually create and update dozens of reports.

Sightfull users also receive dozens of pre-built dashboards based on these metrics, enabling them to easily investigate revenue trends at a highly granular level, identify their root causes, and act on proactive insights regarding time-sensitive business issues.

Related Metrics

Also known as

- Rolling annual recurring revenue

- Rolling annual revenue

- Annualized recurring revenue

- Rolling ARR

Sightfull pre-built ARR Reporting Metric

Sightfull makes GTM easy with rapid no-code revenue analytics.

Sightfull is your automated GTM analytics platform.

Low touch, quick deployment paired with automation ensures fast results across any interface of your choice.