The 6 Types of Revenue Analysis

Co-founder & CTO

Traditionally, finance teams have considered revenue in terms of pure sales, but businesses have come to realize that it encompasses much more than that. Since revenue cannot be quantified and forecasted properly if it’s based entirely on sales data, various types of revenue analysis have come to play a central role in driving business growth and efficiency. This article reviews the six basic approaches companies can take when it comes to SaaS revenue analysis.

What is revenue analysis?

Revenue analysis is the process of reviewing the sources of income generated by a business. Revenue analysis can encompass a number of factors, including reviewing sources, such as what teams and products are driving the most sales, considering trends, such as economic factors or seasonality, and evaluating revenue against peers for a competitive analysis.

Revenue analysis helps businesses better understand their financial health and whether they’re meeting revenue targets. Keeping a close eye on revenue also helps companies identify growth opportunities, evaluate resource allocation, improve forecasting, and ultimately, helps lead the business to long term success.

The main types of revenue analysis

Although there are various types of revenue analysis that businesses can choose from, they should all be focused on the common goal of breaking down silos between departments. While each team has their own unique responsibilities, there must be a clear agreement on which metrics they need to track and who’s responsible for each stage of the funnel. And it’s more than an effort in collaboration—team alignment affects the bottom line. A study by the Revenue Operations Alliance found that companies that align sales and marketing teams achieve 24% faster growth rates and 27% faster profit growth.

Revenue analysis reports can range from creating simple, visualized views of the income generated from sales over a given period, to more advanced reports that cover specific revenue-generating activities such new subscriptions and account upgrades, and all the way to sophisticated filtering of the data by various parameters such as what was sold, where and when it was sold, who it was sold to, how the sales process started, etc.

1. Sales-focused revenue analysis

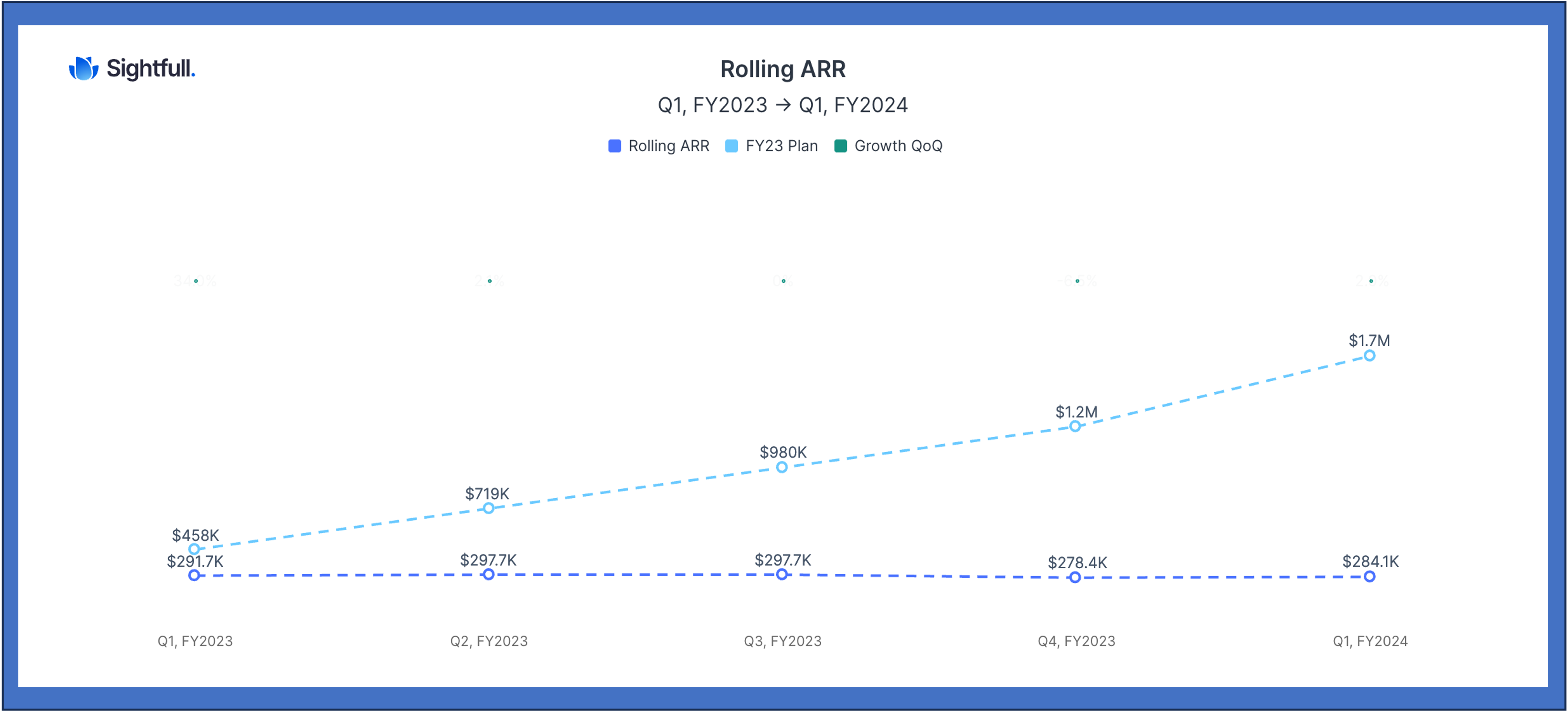

For any organization, the most important KPI is the total sales revenue generated over a given period. A simple sales revenue analysis multiplies the number of units sold by the average price of each item. SaaS vendors usually focus on monthly recurring revenue (MRR) and annual recurring revenue (ARR) which represent the sum of all revenue generated from over a month or a year respectively. In fact, in a study by the Revenue Operations Alliance 51.3% of revenue operations professionals agreed that recurring revenue is the most important metric for engaging leadership.

Below is an example of ARR progression over the course of 5 quarters.

Sales managers are usually tasked with the responsibility of compiling sales revenue reports, and they may do so for individual branches, regions, products or customer segments. Sales leaders can also compile revenue analysis reports per salesperson to identify top performers, as well as those who would benefit most from additional training and from emulating those that are doing better than them.

Sales revenue analysis example

Let’s use a hypothetical B2B SaaS company called OnTheCloud as an example. In a sales-focused revenue analysis, OnTheCloud finds that of its three products, the sales team closes deals for Product 1 much more often than Products 2 or 3.

Product 1 represents 50% of sales-driven revenue while Product 2 and 3 each represent 25%. This analysis helps OnTheCloud optimize sales efforts for Products 2 and 3 so that revenue can be maximized across all product lines.

2. Revenue analysis by department

While revenue analysis needs to align all teams under the goal of adding business value, each department has its own way of doing that. In SaaS companies, for example, the revenue flow begins with the actions of the marketing team before moving into sales and then, finally, to customer experience/success. Taken together, the actions of all these teams have a profound impact on the viability and long-term success of the business. So while revenue analysis spans multiple departments, it also needs to take into account that each team has its own unique needs, targets and priorities.

Revenue analysis that is specific to the marketing team will help inform both their GTM strategies (targeting, positioning, etc.) and their activities (campaigns, events, etc.) Once marketing teams hand over leads to the sales team, the sales team assumes the responsibility to close those deals and needs to analyze sales-specific revenue flow with that goal in mind. Customer success teams are responsible for a customer’s continuing engagement with the business and analyze their numbers with a focus on retaining customers and, in doing so, retaining revenue. Finally, the finance team can take an overall look at revenue flows across the company but also has their own angle regarding what is most important to them such as revenue recognition and payment schedules.

Example of revenue analysis by department

At the hypothetical SaaS company, OnTheCloud, 60% of the revenue is attributed to the sales team, 25% is attributed to the marketing team, and 15% to the customer success team.

Each team digs into their revenue analysis separately to understand what’s influencing revenue within their department. The sales team closely monitors sales pipeline management to understand where improvements can be made in the sales process and funnel.

The marketing team looks at metrics such as MQL to opportunity conversion rate and MQL to customer win rate to understand if they’re bringing the sales team high quality leads.

The customer success team evaluates retention rates and upsell opportunities to make sure they’re making the most of the current customer base.

By looking at these metrics alongside revenue by department and total expenses, OnTheCloud finds that the sales team generates the most revenue but also incurs the most expenses. Meanwhile, customer success has the least amount of expenses alongside below average retention rates. By shifting some of the budget to customer success, OnTheCloud hopes to increase revenue by increasing retention.

3. Revenue analysis by product

Businesses can also approach revenue analysis from a product standpoint. This is especially important for those with multiple products that may differ in their target markets and those who have large product inventories. For example, a retailer might break down their analysis per product or product category in order to identify the best-performing ones.

Conducting a product revenue analysis is valuable for any business, as the insights collected can inform many other business departments. SaaS companies can analyze the revenue down to the product level to understand who is buying each product, as well as where and when they generate the most revenue. This helps the finance teams to make informed decisions about what to invest in at the product level.

Example of revenue analysis by product

At OnTheCloud, Product 1 is bringing in 40% of the total revenue while the Products 2 and 3 are each bringing in 30% of the revenue.

By evaluating the revenue trends over time, OnTheCloud sees that their Product 2 has had steady growth over the course of the last year. Moreover, those who purchase Product 1 are more likely to purchase Product 2.

This analysis helps OnTheCloud maximize revenue from its product portfolio and develop its product, marketing, and sales strategies for the next year.

4. Revenue analysis by customer segment or region

Another way to approach revenue analysis and operations is to target specific customer regions or demographics. This can be especially useful for companies that offer products to different industries or various regions with varying needs, pain points and priorities. It might be that a particular product or service is generating more revenue than expected from a particular customer demographic or region – or vice versa.

By understanding how each customer demographic influences your revenue stream, you’ll be better prepared to identify new or underrepresented market opportunities. Of course, every forward-thinking business starts out with their ideal target customer in mind, but these ideal customer profiles (ICPs) can change and often do. If your product is generating (or losing) revenue from unexpected sources, it’s definitely something you want to know about.

Example of revenue analysis by region

In the below example, OnTheCloud’s Rolling ARR is broken down by region over thecourse of a 6 month period. North America, shown in yellow, has the highest average ARR, followed by EMEA and APAC.

While APAC is driving less revenue than North America or EMEA, it has the highest growth rate, increasing from $2.4M in May of 2023 to $3.4M in October of 2023.

This revenue analysis highlights there is a lot of opportunity for growth and expansion in the APAC region. OnTheCloud can invest more resources into creating a localized strategy for APAC that resonates with this market.

5. Revenue forecast analysis and trends over time

All the types of revenue analysis mentioned above are results-oriented. They look at past data to determine what has previously worked and what hasn’t. However, the revenue operations team also has a secret power – accurate forecasting. By drawing on historical data to analyze previous activities and current trends at scale, today’s revenue analysis platforms can also make accurate predictions that help inform key decision-makers in marketing, sales, customer experience and finance.

Analyzing trends over time is essential for making informed decisions on any major changes to the business model or go-to-market motions. For example, a thorough revenue analysis and forecasting report will provide a more accurate picture of where your business is likely to be in the next year. Equipped with these insights, you can reduce the risk when making key decisions pertaining to areas like staffing, products, targeting and geographical spread.

Example of revenue trends analysis

By comparing revenue generated by each product and team over multiple periods, OnTheCloud can identify trends and patterns. For example, OnTheCloud may observe that the sales of Product 1 have been consistently strong, but typically dip in Q4 due to seasonality. Meanwhile the sales of Product 2 have been growing steadily with much of that growth due to the cross-selling with current customers.

This information can help OnTheCloud forecast revenue for future years, inform sales strategies, and budgets for revenue-driving teams.

6. Revenue analysis by purpose

In a RevOps-oriented business environment, different teams may conduct revenue analysis for several purposes. Traditional types of revenue analysis, such as quarterly business reviews (QBRs) and forecasts, may be managed by the finance department to inform budgeting and determine the areas to invest in. Companies also perform revenue analysis as part of a full business review with the goal of determining the viability of your business model where decisions are typically taken at the board level.

Sales and marketing teams may also conduct revenue analyses in the contexts of their own goals and responsibilities. In some cases, they will also work together to perform analyses to evaluate the effectiveness of their lead and sales funnels. Moreover, sales teams might have sales leaderboards in order to recognize and reward the most effective salespeople and initiatives. Another option is a joint analysis to look into campaign performance, conversions or pipeline health. In other words, if any given operation impacts revenue, then it’s a prime candidate for revenue analysis.

What tools help with revenue analysis?

It takes time to reach a mature revenue analysis model. Because of this, businesses typically start with quarterly business reviews (QBRs) using tools like Excel spreadsheets. This is limited to reporting on the basic top-line metrics such as NDR and ARR.

While these solutions are fine for very small businesses, they will quickly grow out of them as they scale. This is why it’s important to always remember that in the long term your business will outgrow its existing technology stack and need to move to a solution that can accommodate the massive datasets that today’s revenue teams generate.

Transitional solutions such as business intelligence (BI) systems are what companies usually turn to after spreadsheet-based reporting starts to show its limits. These platforms allow you to compile a wide variety of reports and visualizations, but these are typically quite rigid and only data analysts can change existing ones or add new ones. The reports required at this stage include, for example, forecasts, campaign performance and sales leaderboards. Questions handled at this level are along the lines of ‘what’s my NDR by customer segment?’ and ‘how do inbound and outbound leads differ by win rates?’

BI systems provide limited cross-platform connectivity so that the analysis is mostly still isolated by function so that the silos remain (i.e., sales, marketing, finance, etc.). In addition, they are also very time- and resource- intensive, taking months to implement before providing initial results and requiring, on an ongoing basis, a team of data analysts with experience working on the BI system. This team is usually inundated with requests from across the company. Due to the manual nature of their work, they can never answer these queries, even the most urgent ones, in real time or even something close to it.

When it comes to revenue operations, the highest level of maturity comes with having a fully automated and autonomous system that matches the scale of fast-growing businesses (typically those that have more than $5-10M in ARR and/or more than 10 sales reps). Such a solution eliminates the need to use a cumbersome system and multiple analysts in order to aggregate the data and compile it into reports that make sense.

A robust revenue analysis platform can save everyone lots of time and effort - from the revenue leaders to the RevOps team, regardless of their data crunching experience. No more waiting, or spending resources you don’t have, for answers without which you can’t move forward on making strategic business decisions. The platform’s automation and autonomy means that they all get immediate answers to their business questions spanning the entire revenue cycle from leads to renewals.

Spreadsheets slowing you down?

Who is responsible for each type?

While complete automation and visibility across the entire sales pipeline is the apex of revenue operations, the secret to success lies not only in choosing the right technology – but also in adapting your company’s culture. Revenue analysis is all about driving full-funnel accountability so the different functions need to agree on things like which KPIs to track, and that requires a clear picture of who’s responsible for what.

Early stage companies typically tend to get separate reports from each team, while more mature organizations will have a dedicated RevOps team with the other ops teams working closely with them. RevOps is responsible for the overall process, as well as the go-to-market analysis and strategy, identifying positive or negative revenue trends, and highlighting any growth opportunities that they find.

The other ops teams are in charge of their side of the house. For example, Sales, Marketing and Customer Operations teams are responsible for running and reporting on the revenue-generating tactics and specific activities used by their department (such as lead acquisition, closed won deals and customer retention), while the finance team focuses on reporting the metrics that are of specific interest to them.

So many options, what’s my next step?

Understanding the various types of revenue analysis, why they’re important to your business, and who’s responsible for what will help align your teams in pursuit of a common goal. First, you need to figure out what stage your company is in.

Are you a small startup where spreadsheets are just fine for the type of revenue analytics you need? That’s great, just make sure you transition to the next step just before people cursing their spreadsheets for everyone to hear becomes a regular occurrence.

Are you growing fast and thinking of getting a BI system to handle the load of more complex revenue analytics? Consider saving yourself lots and lots of time and money by first implementing an automated revenue analysis solution, and only then adding a BI system to cover the really sophisticated work that you may not even need at the moment.

But more than anything, consider adopting a revenue operations model. By understanding how their activities impact business revenue, every individual in every team will be able to work smarter for the betterment of the organization right down to their own careers.

Want to see an automated and autonomous revenue analysis and optimization solution in action? We’ll be happy to demonstrate!

Frequently asked questions

What are the six types of revenue analysis?

- Sales-focused

- Department-based

- Product-based

- Customer segment/region-based

- Purpose-based

- Forecast trends over time

Access GTM templates and metrics

How to decide which type of analysis to use?

Consider how you will use the final report. Sales and activity-specific revenue reports are typically run on a regular basis, while more extensive reports that break down these numbers per department, product, segment and region are more useful for more in-depth reviews or to figure out the source of revenue leaks.

Who is in charge of running each type of revenue analysis?

You can start by getting separate reports from each team, but as the company matures the responsibility typically moves the RevOps team with the other ops teams working closely with them. The goal is to break down silos between departments while reaching a clear agreement on which metrics to track and who is responsible for each stage of the funnel.

How do we decide which technology to use for each type of revenue analysis?

This answer also depends on the stage of the company. In the early stage companies can make do with relatively simple calculations on spreadsheets, while more sophisticated reports need a Business Intelligence system and data analysts to run it or, for a far less resource-intensive experience, a dedicated revenue analysis and optimization platform.

Talk to an expert

Learn which SaaS revenue analysis approach best suits your company

Automate your pipeline reporting your way

Access all the pre-configured pipeline metrics you need, or build your own pipeline reporting and analytics with self-serve metrics in Sightfull.